Summary: As the first native smart contract platform on Bitcoin, Arch Network integrates Turing-complete smart contract functionality directly into the Bitcoin base layer through a bridge-less architecture, decentralized verification network, and innovative zero-knowledge proof technology, opening up new scenarios such as decentralized finance (DeFi) and cross-chain interoperability for the Bitcoin ecosystem.

Key Points:

- Arch Network is the first platform that natively supports the execution of smart contracts on the Bitcoin main chain, with Turing completeness.

- The Arch Network consists of three key core components: ArchVM, a decentralized verification network, and the FROST+ROAST multiparty threshold signature mechanism.

- Arch Network seamlessly supports native assets such as BTC, Ordinals, and Runes, providing unified management and easy operations.

1. What is Arch Network?

Arch Networkis a Bitcoin native smart contract execution platform that allows dApp developers to execute complex logic directly on the Bitcoin main chain. Its core is the ArchVM virtual machine plus a decentralized validator network, complemented by the innovative FROST+ROAST signature solution, without the need for soft forks or new op-codes, achieving trusted execution and on-chain state management. It is not the traditional Layer 2 or meta-protocol, but a completely new ‘bridge-less second layer’ approach: allowingBTCusers to participate in smart contract interactions without the need for bridging or wrapping.

2. What problem does Arch Network aim to solve?

Bitcoinas the highest market cap cryptocurrency in the world, is well-recognized for its security and decentralization, but limitations in its technical architecture make it difficult to support complex smart contracts. Existing solutions rely on asset bridging or off-chain verification, leading to issues of liquidity fragmentation, trust risks, and user experience bottlenecks. For example:

- Liquidity fragmentation: users must bridge BTC to other chains (such asEthereum) to participate inDeFi, resulting in asset dispersion and high conversion costs.

- Trust risks: bridging protocols rely on centralized custody, posing risks of attack or manipulation.

- Performance bottlenecks: Bitcoin’s block time and size limitations restrict transaction throughput, making it difficult to support high-frequency applications.

Arch Network effectively addresses the above issues by implementing smart contracts directly on the Bitcoin chain through a bridge-less design, state anchoring mechanisms, and parallel execution layers.

3. Core features and advantages of Arch Network

3.1 Bridge immunity and native asset management

Users do not need to transfer BTC to other chains or wrap it as tokens; they can interact directly with Arch contracts using Taproot addresses from wallets such as Xverse, Unisat, Ledger, etc., without intermediary asset migration.

3.2 ArchVM+eBPF execution

The core runtime environment is an eBPF virtual machine compiled from Rust, compatible with the building model of Solana, providing more complex and secure execution logic, deeply integrated with Bitcoin’s UTXO model, enabling the writing of composable and parallel computing smart contracts.

3.3 FROST+ ROAST signature mechanism

Combining FROST (Flexible Round-Optimized Schnorr Threshold) with ROAST (Robust Asynchronous Schnorr Threshold), it achieves dynamic validator set and multiparty synchronous signing, ensuring that the on-chain state is recognized once at least 51% of validators sign, while allowing for asynchronous robust operations.

3.4 State management and parallel DAG architecture

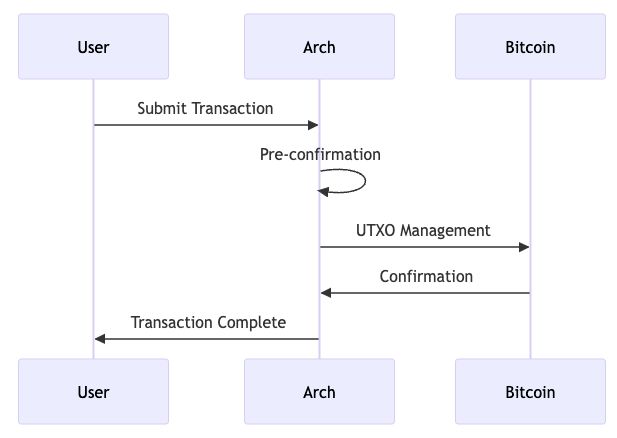

The Arch Network tracks mempool state in real-time, forming a transaction dependency DAG; when a transaction is reorged or removed, it can precisely roll back and replay the affected range, maintaining consistency and allowing pre-confirmation acceleration of processes.

3.5 Seamless compatibility with the Bitcoin ecosystem

Supports native assets such as BTC, Ordinals, and Runes. Users can manage them uniformly in wallets and operate directly in dApps, with no asset fragmentation or cross-chain complexity.

4. Is it superior to competitors?

Compared to traditionalLayer 2, side chains, or meta-protocols (such as state expansion solutions relying on BitVM), Arch possesses significant advantages:

- No bridging, preserving main chain security and liquidity;

- Real-time state pre-confirmation and parallel execution capabilities,addressing Bitcoin’s slow confirmation issues.

- Using cutting-edge multi-party threshold signatures and decentralized verification mechanisms,enhancing the capability to resist centralization and attacks.

5. Future outlook of the Arch Network project

The vision of Arch Network is to partner with collaborators to become a universal execution layer in the Bitcoin ecosystem, driving its evolution toward a dual-track system of ‘global settlement layer + smart contract platform’. With the launch of the mainnet and more developers joining, Arch is expected to unlock the following scenarios:

- A thriving Bitcoin NFT ecosystem: Reducing the minting and trading costs of Bitcoin NFTs through non-bridged designs, attracting artists and collectors.

- Enterprise-grade DeFi applications: Providing a compliant and secure Bitcoin derivatives trading platform for institutional investors.

- Cross-chain asset aggregation: Becoming a hub for interactions between Bitcoin and other chains (such as Ethereum, Solana), enhancing global cryptocurrency asset liquidity.

6. Summary

Arch Network is a truly Bitcoin-native programmable layer, bringing Turing-complete smart contracts and asset transfer capabilities to the Bitcoin main chain, achieving a ‘bridge-free’ DeFi architecture. It realizes a high-performance, composable, and decentralized application execution environment through ArchVM, FROST+ROAST multi-signatures, DAG state management, and dPoS verification network. In the future, with the launch of the mainnet, token incentives, and ecosystem expansion, Arch is expected to become the most core DeFi infrastructure in the Bitcoin ecosystem, evolving Bitcoin from ‘digital gold’ into a true ‘financial infrastructure layer’.

Arch Network is not just a platform, but a technological path that extends the native value of Bitcoin into a programmable financial architecture. It breathes new life into Bitcoin while respecting its philosophy. Among numerous bridging solutions, Arch possesses the most native, secure, and comprehensive design, making it a key bridge for the Bitcoin ecosystem to move towards the future.

Recommended reading:

- Why choose MEXC contract trading?Gain insights into the advantages and features of MEXC contract trading to seize opportunities in the contract domain.

- How to participate in M-Day? Master the specific methods and skills to participate in M-Day, so you won’t miss out on daily contract bonus airdrops worth over 70,000 USDT.

- Contract trading operation guide (App)Learn about the operational process of contract trading on the App, making it easy for you to get started and master contract trading.

Join MEXC and Get up to $10,000 Bonus!

Sign Up