Executive Summary

A new wave of behavioral data from MEXC reveals a significant generational shift in crypto trading: 67% of Gen Z users (ages 18–27) are already using or are open to relying on AI-powered tools to make trading decisions. The findings are based on in-platform activity — activation rates of AI bots, usage frequencies, trade execution patterns, and interface engagement.

The research shows that Gen Z is not only curious about AI, but actively engaged in applying it to their trading routines. They are automating routine decisions, minimizing emotional reaction, and leveraging AI interfaces as their core trading environments. This marks a departure from conventional, chart-based approaches and a shift toward real-time, adaptive systems that cater to Gen Z’s demand for intuitive, responsive, and fast-paced digital experiences.

Behavioral Intelligence — How Gen Z Uses AI

The MEXC report is based on the platform’s internal analytics, tracking user activity of over 780,000 Gen Z accounts in Q2 2025. The findings are derived from backend data, including bot activation logs, trading execution via AI tools, interaction time metrics, and behavioural comparisons across age brackets. These results reflect observed behavior in real trading environments.

Key Metrics:

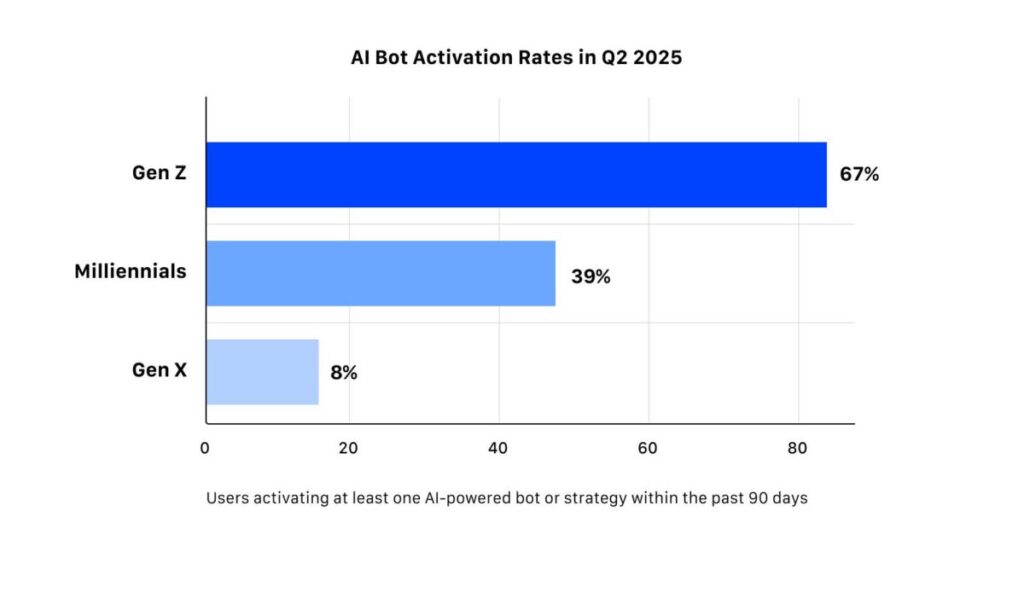

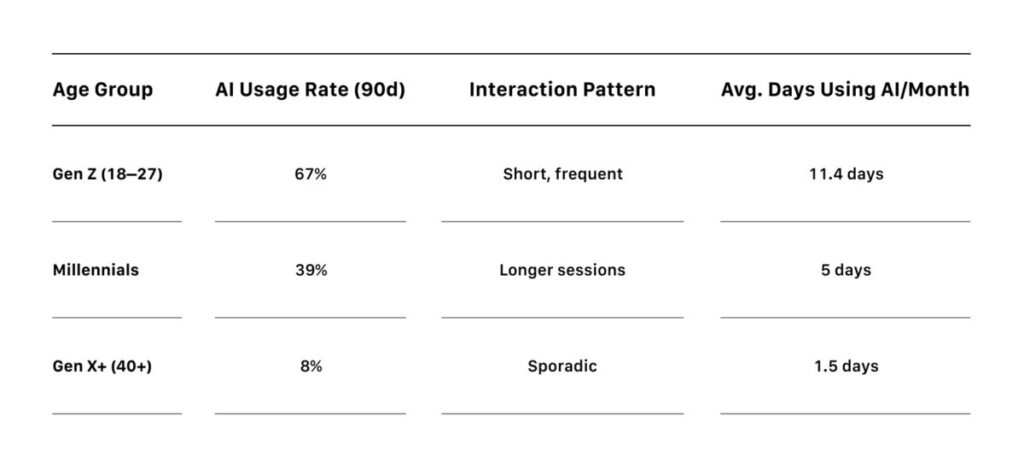

- 67% of Gen Z users activated at least one AI-powered bot or strategy within the past 90 days.

- 22.1% showed regular engagement (4+ interactions/month) with AI tools or automated rule-based systems.

- Gen Z users account for 60% of all AI bot activations on MEXC.

- Gen Z users average 11.4 days/month using AI tools — more than double the engagement of users over 30.

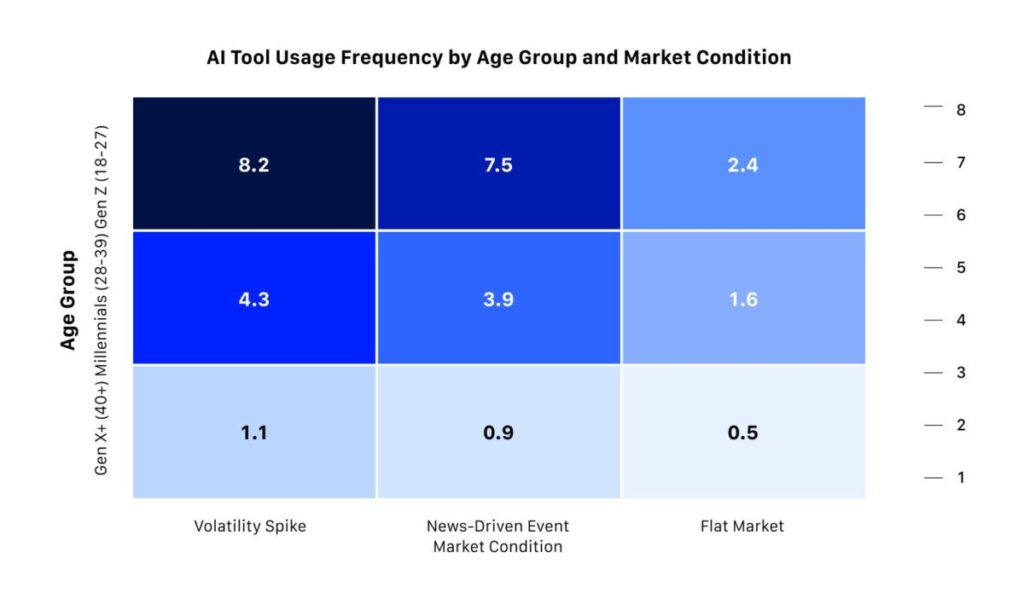

These metrics suggest a consistent pattern of usage that intensifies during times of market volatility or news-based uncertainty. Additional data reveal that Gen Z users check AI-generated signals 2.4x more often than they use traditional technical indicators. 73% of them activate bots during market spikes, but intentionally deactivate them during low-volume or sideways periods. For comparison, only 22% of millennials and 7% of GenX users tend to use AI during high volatility.

The trend suggests a deep understanding of how and when automating can be applied. Young users are choosing strategic moments to deploy AI, highlighting that for Gen Z, AI is a tool for enhancing human decision-making under pressure.

The Psychology Behind the Shift

Gen Z’s deep trust in AI trading systems stems from broader psychological and behavioral patterns shaped by their digital upbringing. MEXC’s data reveals that this cohort views AI as a controlled filter against emotional and cognitive overload.

During periods of high market tension, Gen Z traders using bots experienced 47% fewer panic-sell events compared to manual traders. This “emotional buffering” effect is critical — bots act as anchors in volatile environments, allowing traders to remain aligned with strategy rather than fear.

Rather than relinquishing control, AI use reflects a desire for structured delegation. Gen Z configures conditions, then lets automation handle execution — creating a psychological distance from loss aversion and short-term stress. This reflects a broader trend of young users’ trust and reliance on AI for various tasks, confirmed by recent data from authoritative sources. More than half of surveyed GenZ respondents said they see ChatGPT as a co-worker or even a friend, according to a May 21 report from Resume.org. Nearly half of Gen Z workers also said they’d rather ask ChatGPT questions than consult their boss, the report found.

MEXC findings show that the interaction with AI tools is also gamified: bot usage spikes during news surges or volatility events, then quickly drops off. Gen Z’s preference for quick tactical engagement mirrors patterns seen in social media and gaming. They seek tools that respond as fast as the market moves, without demanding constant manual oversight.

Ultimately, Gen Z’s AI use is rooted in clarity and speed, with tools serving as their mental safety net in chaotic markets.

AI as a Risk Management Layer

The use of AI tools among Gen Z is also transforming how risk is managed in crypto trading. Far from just automating convenience, these tools shape a disciplined trading culture.

MEXC’s data shows that:

- Gen Z users with AI bots are 1.9x less likely to reactively trade in the first 3 minutes of major events — a critical period for emotional mistakes.

- They are 2.4x more likely to use structured stop-loss and take-profit mechanisms, indicating a stronger emphasis on boundaries.

- 58% of all Gen Z AI interactions initiated during spikes in MEXC’s internal volatility index.

This suggests a semi-automated hedging mindset, where AI is enforcing discipline when it matters most. In this model, AI becomes a form of emotional insurance, allowing Gen Z to remain agile while protecting against irrational overreactions.

How Gen Z Differs from Millennials

Cross-generational analysis reveals a growing behavioral divergence between Gen Z and Millennials in the context of AI-assisted crypto trading. MEXC’s internal data highlights key contrasts in how these two cohorts engage with technology, manage risk, and perceive control over trading environments.

Gen Z treats AI as a tool for environment configuration, not just automation. They are more likely to view trading as an interactive, real-time experience — mirroring their use of platforms like TikTok, Snapchat, and Discord, where control is exercised through modular, user-defined triggers and interface layers. The report by crypto exchange Bitget has previously revealed that a high share of Gen Z traders tend to use copy trading, following social media influencers and automating their trading experience. This generation builds short-term conditions and execute through responsive systems that match their digital habits.

By contrast, Millennials — who came of age during the Web 2.0 boom — lean toward more structured, thesis-driven investment strategies. They tend to engage in fewer interactions but spend more time per interaction, analyzing charts, reading reports, and crafting deliberate plans. Their AI usage often serves as a supplement to pre-set strategies, rather than a dynamic decision-making engine.

In psychological terms, Gen Z’s usage reflects fluid control — they toggle autonomy on and off based on emotional state, market noise, and attention bandwidth. Millennials, on the other hand, aim for total control, where they manually adjust their exposure and rely more on structured frameworks.

What’s Next for the AI-Native Generation

Looking ahead, Gen Z’s demands and growing presence in the financial market will continue to reshape how the crypto market evolves. The growing demand for automated yet customizable trading tools will drive AI’s evolution from a feature into a foundational element of trading interfaces. Global market research shows that the AI trading platform market is projected to grow at a CAGR of over 20% from 2025 to 2034, reaching an estimated $69.96 billion by 2034. This trend is driven by the increasing demand for real-time data analysis, predictive analytics, and automation among younger investors.

Gen Z is already redefining crypto trading through real-time engagement with AI tools. Looking ahead, a more profound transformation is on the horizon: AI is poised to become the default portfolio manager for the next generation of traders.

By 2028, over 80% of Gen Z traders are projected to rely on AI for full-cycle portfolio management, including dynamic asset rebalancing, cross-chain yield optimization, tax automation, and risk-tiered allocations. The trading interface will evolve from dashboards to intelligent agents: AI that listens, reacts, and explains.

However, this transformation also comes with caveats. AI tools are only as reliable as their data inputs and underlying models. Overreliance can introduce a false sense of security, especially during black swan events or when systemic biases are embedded into models. Platforms must remain vigilant in designing transparent, auditable AI systems, and users must be educated about the boundaries of automation.

Join MEXC and Get up to $10,000 Bonus!