MEXC Earn is a comprehensive platform that allows users to stake their digital assets and earn passive income with APR up to 777%.

Whether you’re holding Bitcoin, Ethereum, stablecoins, or altcoins, MEXC provides flexible and fixed staking options to maximize your crypto earnings.

This guide covers everything you need to know about how to stake tokens on MEXC in 2025, including product types, step-by-step instructions, and strategies to maximize your rewards.

What is Digital Asset Staking on MEXC?

Staking is the process of locking your cryptocurrency to support blockchain operations and earn rewards.

MEXC Earn simplifies this process through three product categories: Flexible Savings for instant access, Fixed Savings for higher yields with lock periods, and On-Chain Earn for DeFi opportunities.

As of December 2025, MEXC supports 30 digital assets with APR ranging from conservative yields to promotional rates up to 777%.

MEXC Earn: Five Ways to Stake Your Digital Assets

1. Flexible Savings (No Lock-Up Period)

Flexible Savings allows you to earn interest without any lock-up period.

Your crypto remains accessible for trading or withdrawal at any time while continuously generating daily interest.

When you stake tokens through this method, simply hold assets in your Spot account, and the system automatically calculates your minimum daily holdings to determine yield.

Key Features:

- No lock-up period – unstake anytime

- Daily interest distribution

- APR typically 1-8% for major cryptocurrencies

- Minimum amounts: 0.0001 BTC, 0.001 ETH, 1 USDT

How It Works: When you join a Flexible Pool on Day T, the system begins counting your holdings on T+1, yield starts generating on T+2, and you receive your first interest distribution on T+3.

Daily Yield Example: If you hold 10,000 USDT at 2.8% APR:

Daily Yield = 10,000 × 2.8% ÷ 365 ≈ 0.77 USDT per day

2. Fixed Savings (Higher APR with Lock Periods)

Fixed Savings offers higher APR in exchange for locking your digital assets for 7-90 days.

This product is ideal for long-term holders seeking premium returns.

When you stake in a Fixed Pool, your APR is locked at subscription, guaranteeing your rate until maturity.

Popular Fixed Staking Products:

| Asset | Term | Est. APR Range | Min. Amount |

|---|---|---|---|

| BTC | 7-30 days | 3-10% | 0.0001 BTC |

| ETH | 7-30 days | 4-15% | 0.001 ETH |

| USDT | 7-90 days | 5-25% | 10 USDT |

| USDC | 7-90 days | 5-20% | 10 USDC |

Timeline Example for BTC Fixed Staking:

- Day T: Stake your BTC

- T+1: Yield generation begins

- T+16: Lock period ends, assets can be unlocked

- T+19: Receive all principal + accumulated rewards

3. On-Chain Earn (DeFi Staking)

On-Chain Earn connects you to decentralized finance staking opportunities.

This includes liquid staking and DeFi protocols offering premium yields.

DeFi staking involves locking crypto tokens into smart contracts to earn rewards, similar to putting money in a bank but with potentially higher returns.

Featured On-Chain Product: MEXC offers Solana Liquid Staking, allowing you to stake SOL with an estimated APY of 5-12% and a minimum amount of 0.1 SOL. When you stake SOL, you receive MXSOL tokens that represent your staked position while continuing to earn rewards.

Daily Yield Calculation: User’s daily yield = Staking amount × APY ÷ 365

Example: Stake 10 SOL at 8% APY = 10 × 8% ÷ 365 ≈ 0.0022 SOL daily

4. Futures Earn (Earn While Trading)

Futures Earn is designed for active traders who hold funds in their Futures account. Once activated, your eligible Futures balance automatically generates interest while remaining available for trading—no need to choose between earning yield and seizing market opportunities.

Key Features:

- Earn up to 20% APR on USDT, USDC, and USDE held in Futures accounts

- No lock-up period—funds remain available for trading

- Higher APR for larger position values ($100,000+ unlocks bonus rates)

- Interest calculated daily and distributed to your Spot account

Best For: Active futures traders who want to maximize capital efficiency by earning on idle margin.

5. Hold and Earn (Earn by Simply Holding)

Hold and Earn is the simplest way to earn passive income—just hold supported tokens in your Spot account, and interest accrues automatically. No staking, no lock-up, and full flexibility to trade or withdraw anytime.

Key Features:

- Completely passive—no manual enrollment required for most tokens

- Full liquidity—trade, withdraw, or use tokens anytime

- Daily interest distribution

- Support for various trending tokens

How It Works: Interest is calculated based on your minimum daily holdings of supported tokens. The formula is the same: Daily Interest = Holding Amount × Est. APR ÷ 365

Best For: Casual holders who want to earn on tokens they’re already holding without any commitment.

How to Stake Tokens on MEXC: Step-by-Step Guide

Step 1: Prepare Your MEXC Account

Create an account on MEXC, complete KYC verification, and ensure you have crypto in your Spot account.

You can deposit crypto from external wallets or buy directly with fiat currency through MEXC’s Buy Crypto feature.

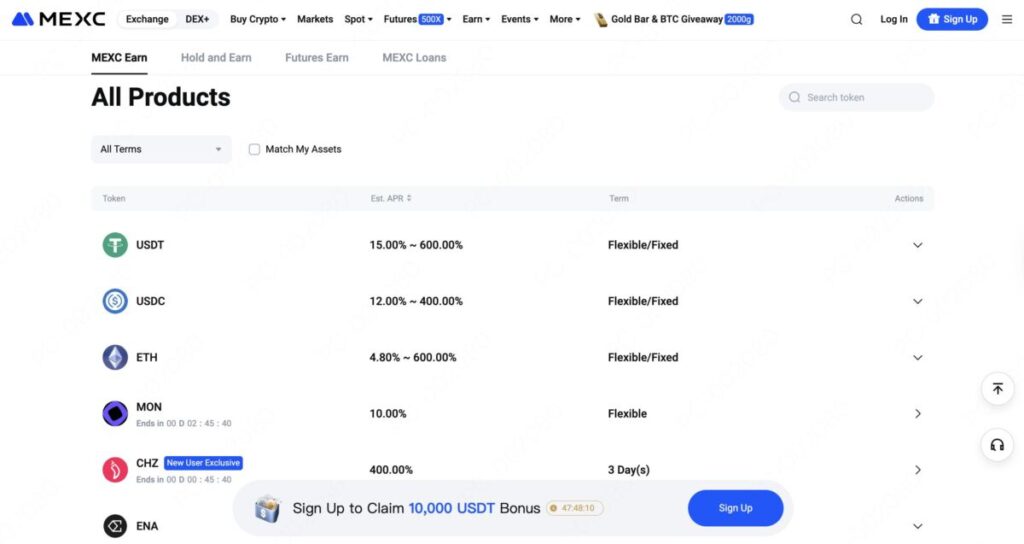

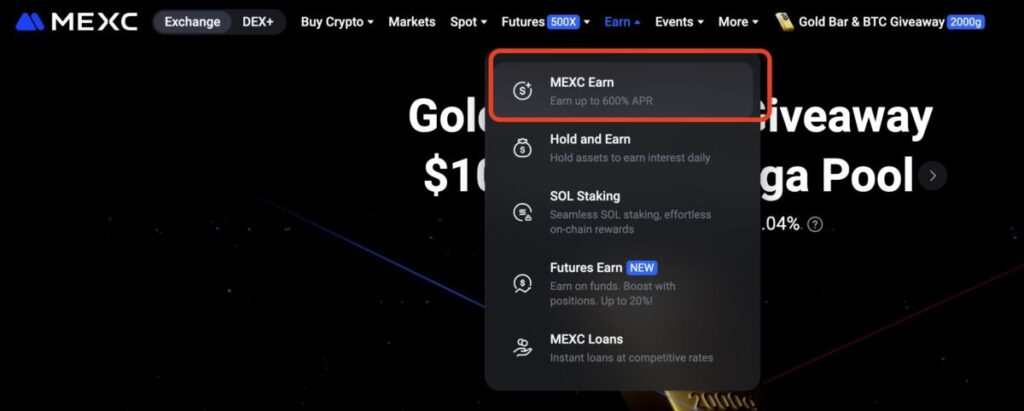

Step 2: Navigate to MEXC Earn Platform

From the top menu bar, click on “MEXC Earn” to access the platform. You can also visit directly: https://www.mexc.com/staking

Step 3: Choose and Subscribe to a Staking Product

For Flexible Savings: Browse available pools, click your desired cryptocurrency, review APR and terms, then click “Subscribe” or “Trade” to enable automatic staking.

For Fixed Savings: Select your cryptocurrency and preferred term length, enter the staking amount (must meet minimum), review estimated rewards, click “Stake Now” and confirm.

For On-Chain Earn: Navigate to the On-Chain Earn tab, select your DeFi product (such as Solana Liquid Staking), enter amount, review on-chain details, and confirm.

Comparing MEXC Staking Products

| Feature | Flexible Savings | Fixed Savings | On-Chain Earn | Futures Earn | Hold and Earn |

|---|---|---|---|---|---|

| Lock Period | None (Instant) | 7-90 days | Flexible | None | None |

| Est. APR | 1-8% | 5-50% | Up to 777% | Up to 20% | Varies by token |

| Liquidity | Highest | Lowest | Medium | Highest | Highest |

| Account Type | Spot | Spot | Spot | Futures | Spot |

| Best For | Short-term holders | Long-term investors | DeFi enthusiasts | Active traders | Casual holders |

| Risk Level | Low | Low | Medium | Medium | Low |

Maximizing Your Staking Rewards

Best Practices for Digital Asset Staking

1. Ladder Your Staking Terms: Don’t lock all assets in one pool. Distribute 33% each across Flexible Savings (immediate access), 30-day Fixed Savings, and 90-day Fixed Savings. This ensures regular maturity dates while maximizing APR.

2. Compound Your Rewards: Reinvest daily interest instead of withdrawing to benefit from compound growth. For example, 10,000 USDT at 10% APR compounded daily grows to 11,052 USDT in year 1 (versus 11,000 with simple interest).

3. Take Advantage of Promotional Rates: MEXC frequently launches limited-time high-yield events with APR up to 777%. Set up notifications and act quickly as these pools operate first-come, first-served.

4. Diversify Across Asset Types: Balance your portfolio: 40% stable assets (USDT/USDC) for predictable returns, 40% blue-chip crypto (BTC/ETH) for growth plus yield, and 20% high-yield altcoins for promotional rates.

Risk Management Tips

While staking earns interest, remember that cryptocurrency values fluctuate.

Stablecoin staking (USDT, USDC) mitigates price volatility but offers lower yields.

Fixed staking prevents access during market opportunities, so carefully consider your liquidity needs. Always enable 2FA, use withdrawal whitelists, and only stake amounts you won’t need short-term.

Frequently Asked Questions

Is staking digital assets on MEXC safe?

Yes, MEXC employs multi-signature authorization, and regular security audits. However, all crypto investments carry inherent risks. Always enable 2FA and follow security best practices.

What’s the minimum amount to start staking?

Minimums vary: 0.0001 BTC, 0.001 ETH, 1-10 USDT/USDC. Most altcoins have very low minimums. Check specific product pages for exact requirements.

How often are rewards distributed?

Flexible Savings: Daily (T+2 after joining). Fixed Savings: Daily accrual, distributed at maturity. On-Chain Earn: Daily distribution. All rewards are automatically credited to your account.

Can I unstake anytime?

Flexible Savings: Yes, instant with no penalties. Fixed Savings: No, must wait until lock period ends. Early redemption may result in penalties. On-Chain Earn: Yes, but requires 1-5 days processing.

How is APR calculated?

Daily Interest = Staking Amount × APR ÷ 365. APR rates are dynamic and change based on market demand, total platform stakes, and promotional campaigns. Always check current rates before subscribing.

Conclusion

Staking digital assets on MEXC provides accessible passive income opportunities for all investor types.

With five earning methods—Flexible Savings, Fixed Savings, On-Chain Earn, Futures Earn, and Hold and Earn—you can choose products matching your risk tolerance and liquidity needs.

APR ranges from conservative stable yields to promotional rates up to 777%. Start with Flexible Savings or Hold and Earn to explore the platform risk-free, then graduate to Fixed Savings or specialized products for higher returns.

Visit the MEXC Earn platform to begin generating passive income today.

Disclaimer: Cryptocurrency staking involves risk including market volatility and potential loss of funds. APR rates are subject to change. This content is for informational purposes only and should not be considered financial advice. Always do your own research before investing.

Join MEXC and Get up to $10,000 Bonus!

Sign Up