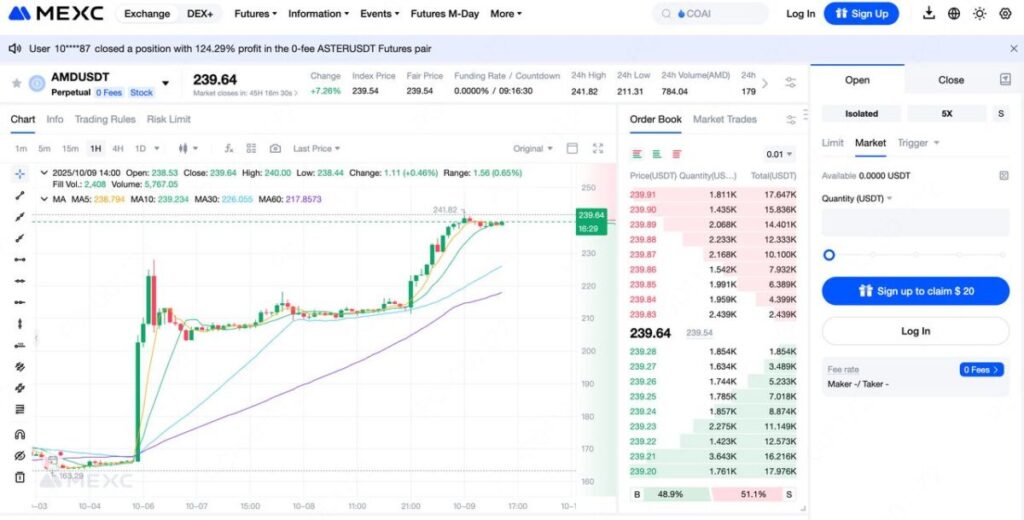

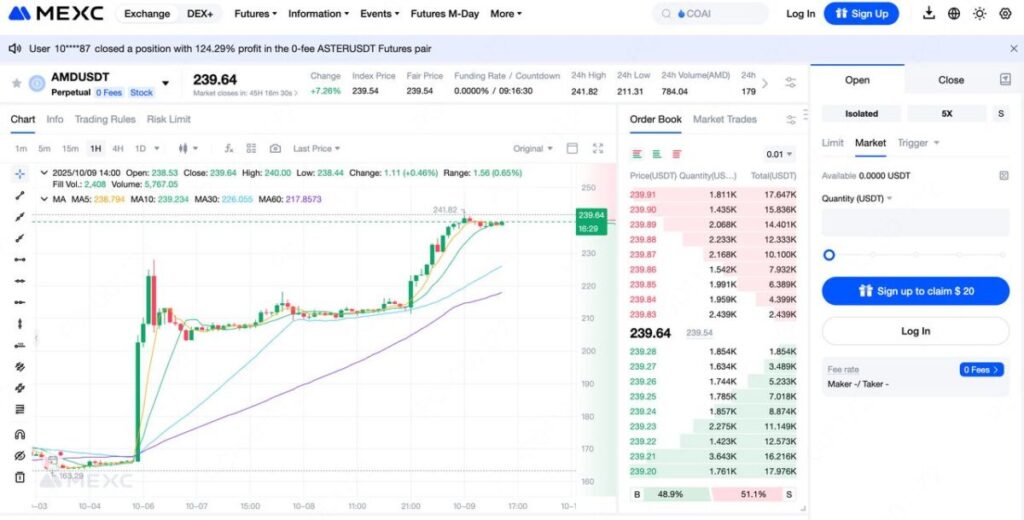

Pada 6 Oktober 2025, saham Advanced Micro Devices (AMD), salah satu perusahaan paling berpengaruh di industri semikonduktor, mencatatkan lonjakan luar biasa lebih dari 30% dalam satu hari. Lonjakan ini menjadi yang terkuat dalam hampir tiga bulan terakhir, menandakan penilaian ulang yang signifikan terhadap perusahaan tersebut.

Kenaikan saham AMD tidak hanya memicu euforia di pasar saham tradisional AS, tetapi juga mengguncang dunia kripto, di mana pasangan perdagangan tokenisasi AMD, AMDUSDT, mengikuti jejak yang sama di platform seperti MEXC.

TL;DR

- Saham AMD di pasar AS dan pair token AMDUSDT di MEXC melonjak, menjadi pusat perhatian di sektor AI dan kripto.

- Kemitraan jangka panjang AMD dengan OpenAI dalam pengembangan chip AI menandakan langkah besar AMD untuk terlibat langsung dalam perlombaan infrastruktur AI.

- Citigroup menaikkan target harga AMD menjadi $215, dengan alasan pertumbuhan kuat pada bisnis chip AI dan data center, serta kapitalisasi pasar yang kini melampaui $300 miliar.

- AMDUSDT menjadi contoh penting dari saham tokenisasi yang memungkinkan perdagangan saham AS 24/7 menggunakan USDT tanpa batasan geografis.

- Perpaduan antara saham teknologi tradisional dan keuangan berbasis blockchain menandakan pergeseran struktural besar dalam pasar modal global, dengan AMD berada di garis depan perubahan ini.

Kenaikan AMDUSDT

Pada 6 Oktober, AMDUSDT, mencatat lonjakan lebih dari 30% dalam beberapa jam di platform MEXC. Kenaikan ini tidak hanya menggambarkan spekulasi, tetapi juga tren yang lebih luas, yakni pencerminan nilai saham teknologi global dalam pasar blockchain.

Katalis utama dari lonjakan ini adalah pengumuman AMD dan OpenAI yang menandatangani perjanjian pasokan chip AI untuk beberapa tahun mendatang. AMD akan memasok GPU berkinerja tinggi dan akselerator pusat data untuk OpenAI, sekaligus memberikan opsi ekuitas strategis yang menyatukan masa depan kedua perusahaan dalam ekosistem AI.

Setelah pengumuman tersebut, saham AMD melonjak 30% bulan ini, mencapai penutupan tertinggi sejak 2021 dengan market cap lebih dari $300 miliar.

Perusahaan Besar Web2 Bertemu Web3, Langkah Awal Tokenisasi!

Tokenisasi saham adalah representasi saham dunia nyata yang dipindahkan ke dalam blockchain dengan token yang memiliki nilai setara. Hal ini memungkinkan para investor untuk membeli dan menjual saham menggunakan cryptocurrency seperti USDT, dengan akses ke pasar yang tersedia setiap saat.

Salah satu contoh yang jelas dari tokenisasi ini adalah AMDUSDT. Nilai dari saham tokenized ini didorong oleh dua elemen utama yang saling melengkapi:

- Aspek tradisional – Termasuk pertumbuhan pendapatan AMD, inovasi chip, dan kekuatan keuangan perusahaan.

- Mekanisme pasar kripto – Meliputi kedalaman likuiditas, perdagangan tanpa henti, dan akses global tanpa batasan.

Saat saham AMD mengalami lonjakan di pasar tradisional, AMDUSDT dengan cepat merespons di blockchain, mencerminkan sentimen pasar global dalam waktu nyata.

Kekuatan Industri AMD dan Siklus Penilaian Ulang

Lonjakan AMD baru-baru ini bukan sekadar lonjakan acak; ini mencerminkan pergeseran besar dalam aliran modal menuju infrastruktur AI. Sebagai pemain utama dalam komputasi berkinerja tinggi yang sejajar dengan NVIDIA, AMD kini memasuki fase penting dalam penilaian ulang perusahaan.

Perubahan ini mencerminkan bagaimana infrastruktur AI dan pasar modal berbasis blockchain mulai saling melengkapi.

Kemitraan Strategis dengan OpenAI

Pada awal Oktober 2025, AMD dan OpenAI mengumumkan kemitraan strategis jangka panjang. AMD akan menyuplai seri akselerator AI MI300X yang kuat, sementara OpenAI mendapatkan opsi untuk pengadaan chip dalam skala besar di masa depan.

Kesepakatan ini menandai pergeseran penting dalam peta jalan AI AMD, mengubahnya dari sekadar pemasok perangkat keras menjadi pendorong utama dalam perkembangan AI generatif. Pengumuman ini memicu lonjakan harga saham AMD dan peningkatan pembelian instan di AMDUSDT, menegaskan adanya keselarasan antara pasar tradisional dan pasar kripto.

Pertumbuhan Pesat di Sektor Pusat Data

Laporan keuangan AMD untuk Q2 2025 menunjukkan pertumbuhan luar biasa di sektor pusat data. Pendapatan dari sektor ini meningkat 47% dibandingkan tahun lalu dan hampir 20% dibandingkan kuartal sebelumnya, menjadikannya lebih dari 40% dari total pendapatan untuk pertama kalinya.

Peningkatan adopsi akselerator AI AMD oleh penyedia server besar semakin memperkuat posisi AMD dalam ekosistem AI. Platform ROCm (Radeon Open Compute), yang merupakan alternatif terbuka untuk CUDA milik NVIDIA, semakin menjadikan AMD sebagai penyedia solusi infrastruktur AI yang lengkap, mengubah bisnis AMD dari sekadar “penjual chip” menjadi “platform infrastruktur AI.”

Penilaian Ulang Pasar dan Peningkatan Kepercayaan Institusional

AMD kini mengalami penilaian ulang yang signifikan. Citigroup baru-baru ini menaikkan target harga saham AMD dari $180 menjadi $215, dengan beberapa analis memproyeksikan bahwa market cap-nya bisa mencapai lebih dari $400 miliar dalam dua tahun ke depan.

Hal ini menandai perubahan penting dari AMD yang dulunya dianggap saham siklikal PC menjadi “aset infrastruktur AI yang sangat berharga.” Di sisi pasar kripto, metrik on-chain seperti minat terbuka dalam futures AMDUSDT meningkat pesat, menunjukkan peningkatan kepercayaan dari investor institusi dan para trader kripto.

Cara Trading Saham AS Tokenized di MEXC

MEXC kini menawarkan perdagangan tokenized untuk beberapa saham besar AS seperti COIN, NVDA, GOOGL, META, dan TSLA, semuanya tersedia dalam format kontrak perpetual bergaya kripto.

Trading saham tokenized di MEXC sangat mudah:

- Pada halaman Futures MEXC, ketik nama saham yang diinginkan (misalnya, “AMD”) di kolom pencarian.

- Pilih kategori Stock untuk mengakses aset tokenized yang tersedia.

- Mulai trading seperti halnya kontrak perpetual kripto.

Note: Kontrak saham tokenized saat ini hanya mendukung mode margin terisolasi.

Strategi Investasi dan Pandangan Risiko

Bagi para trader yang fokus pada AMDUSDT, kondisi pasar saat ini menawarkan peluang dalam berbagai dimensi.

- Jangka Pendek: Trader dapat memanfaatkan level support dan resistance utama untuk menangkap volatilitas menggunakan kontrak perpetual.

- Jangka Menengah hingga Panjang: Ekspansi AMD dalam bisnis AI dan pusat data menjadikannya aset inti yang sangat dipercaya dalam portofolio teknologi atau saham digital.

Namun, ada beberapa risiko yang tetap perlu diperhatikan.

- Persaingan: NVIDIA dan Intel terus mengalokasikan dana untuk riset dan pengembangan (R&D).

- Hambatan Makro: Perlambatan ekonomi global dapat memperlambat pengeluaran pusat data perusahaan.

- Risiko Penilaian: Rasio P/E AMD saat ini mendekati titik tertinggi historis, sehingga koreksi jangka pendek menjadi hal yang mungkin terjadi.

Investor cerdas sebaiknya mengelola eksposur dengan hati-hati dan menyelaraskan toleransi risiko mereka dengan jangka waktu investasi yang dimiliki.

AMDUSDT dan Tokenisasi

Lonjakan pesat AMDUSDT lebih dari sekadar rally harga tapi ini adalah sinyal dari percepatan real-world assets (RWA). Sebagai salah satu saham AS yang paling awal dan diakui dalam bentuk token, perdagangan AMD on-chain menunjukkan bagaimana teknologi blockchain menghilangkan batasan-batasan dalam keuangan tradisional.

Transformasi ini lebih besar dari perusahaan manapun. Hal ini memperlihatkan bagaimana infrastruktur Web3 sedang mendigitalisasi pasar modal global, meningkatkan likuiditas dan transparansi bagi semua peserta.

Kinerja AMD memberikan contoh nyata bagaimana narasi AI dan keuangan blockchain dapat berkonvergensi untuk merombak perilaku pasar.

Kesimpulan

Lonjakan luar biasa dari AMDUSDT tidak hanya mencerminkan reli harga semata, tetapi juga menandakan momen penting dalam konvergensi antara inovasi teknologi dan keuangan blockchain.

Dengan kemajuan teknologi AI yang mendorong valuasi, dan tokenisasi aset dunia nyata yang semakin pesat, AMDUSDT menjadi contoh nyata bagaimana pasar tradisional dan pasar crypto semakin saling terkait, memungkinkan akses global dan fleksibel ke aset teknologi bernilai tinggi.

Lebih dari sekadar spekulasi, membeli AMDUSDT adalah bagian dari partisipasi dalam fase baru evolusi keuangan yang memanfaatkan kekuatan blockchain.

Bergabung dengan MEXC dan mulai trading hari ini

Daftar