1. Introduction

On October 11, 2025, the crypto market experienced the largest flash crash in history, with liquidations totaling $19 billion within 24 hours. Market sentiment turned sharply negative, fear dominated, and investor risk aversion soared. Massive futures positions were forcibly liquidated, traders lowered leverage to hedge risk, and overall market activity dropped significantly. In the wake of this unprecedented shock, futures trading sentiment shifted from aggressive speculation to a more cautious focus on major cryptocurrencies.

2. Shift in Futures Trading Market Sentiment: Focus on Major Coins Over Altcoins

Following the Oct 11 Crypto Flash Crash, market risk appetite declined sharply, prompting futures traders to reevaluate their asset allocations. Due to their higher volatility and sensitivity to market dynamics, altcoins experienced significantly larger declines: while Bitcoin and Ethereum fell by 7.3% and 12% respectively, many altcoins dropped between 70% and 90%. Short-term speculative funds were flushed out, leaving mostly long-term value-driven capital. In short, the market shifted from leveraged play to asset selection. Under this trend, traders increasingly avoided highly volatile altcoins and concentrated on BTC, ETH, SOL, BNB, and other relatively stable major coins.

The renewed focus on major coins has clear fundamentals. First, BTC, ETH, and other large-cap assets offer deep liquidity and demonstrate stronger resilience in extreme conditions. Second, institutional investors favor these four core assets: BTC, ETH, SOL, and BNB are seen as the most liquid capital hubs, often chosen for institutional accumulation and likely to lead the next rebound. In contrast, many small-cap tokens experienced liquidity crunches and forced revaluations during the storm. As a result, both spot and futures markets have seen capital flowing back to major coins, with trading activity increasingly concentrated in these leading assets.

Notably, exchanges are also adapting to this preference shift. Leading centralized exchanges have strengthened support for major coin futures. For instance, MEXC maintained system stability during extreme conditions and, following the event, introduced 0-fee futures trading for BTC, ETH, BNB, and SOL. These measures provided deeper liquidity and lower costs, naturally attracting futures traders toward major coins, allowing them to manage risk while capturing rebound opportunities.

3. Post-Black Swan Event: Comparative Trading Volumes of Major Coin Futures on Exchanges

The shift in the futures market is also reflected in exchange data.

Compared to the pre-zero-fee period, BTC, ETH, SOL, and BNB accounted for a 135% increase in MEXC’s trading volume, while all other trading pairs declined by 35%. In other words, the overall rise in platform volume was driven primarily by the surge in major coin futures trading. This further confirms the earlier conclusion: in the current volatile market, major coins have become the primary destination for both safe-haven capital and trading activity.

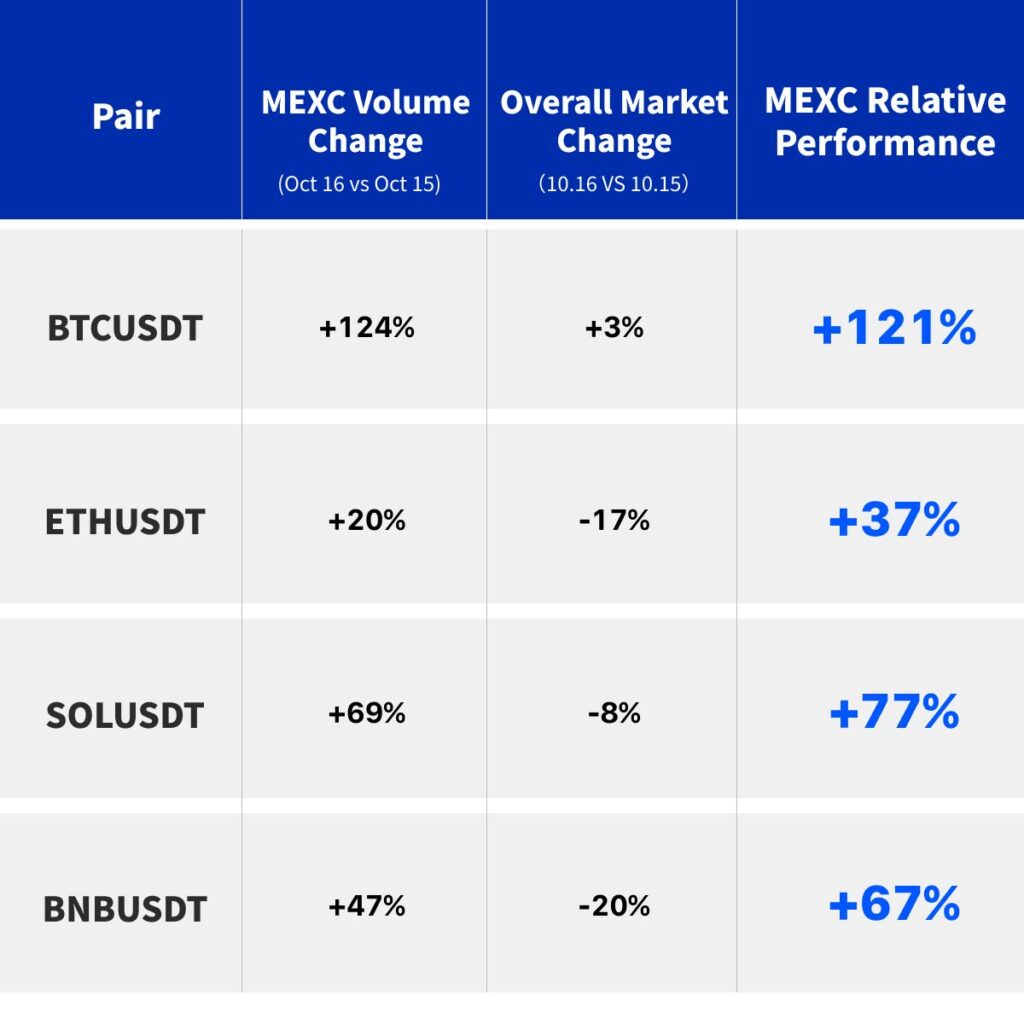

During the market consolidation, major coin futures saw structural growth on certain platforms. On MEXC, BTC futures volume on October 16 alone rose 124% compared to the previous day, while total BTC futures volume across the market increased only about 3%. ETH futures on MEXC grew 20%, whereas the overall market fell roughly 17%. SOL futures surged 69%, in contrast to an 8% decline in market volume. BNB futures increased 47%, while the market overall dropped around 20%. This indicates that despite the same volatile market conditions, MEXC achieved positive growth in trading volume, attracting a large inflow of hedging funds into its major Futures markets.

These trends highlight MEXC’s relative advantage in a volatile market. This success is partly due to the platform’s stability and security measures during extreme conditions, and partly due to its innovative initiatives that help users reduce trading costs.

In mid-October, MEXC officially launched the Blue Chip Blitz zero-fee event for major coin futures, offering a prize pool of up to $2 million. The event focused on BTC, ETH, BNB, and SOL futures, waiving trading fees for these assets for one month starting Oct 15, 2025. Following the recent market downturn, this initiative significantly lowered trading costs for users, addressing investors’ urgent need to cut costs and conserve capital in a weak market.

At the same time, the platform’s operational stability and asset security—including a sizable futures insurance fund and robust reserves—further reinforced user confidence. In other words, MEXC’s zero-fee trading incentives, combined with abundant liquidity, allow users to participate in the market more efficiently and at lower costs. These user-focused measures significantly enhance trader retention and largely explain MEXC’s surge in trading volume.

4. Platform Performance Comparison: Fees and Liquidity for Major Coin Pairs

As shown in the previous trading volume data, BTC, ETH, SOL, and BNB Futures have become the core focus in a volatile market. Next, we will take a closer look at MEXC’s performance in two key dimensions—fees and liquidity—to reveal how the platform provides traders with lower costs and higher market efficiency, making it one of the preferred choices during market fluctuations.

4.1 Fee Analysis

In general, standard Futures trading fees across exchanges are around 0.02% for Makers and between 0.04%–0.055% for Takers, with discounts typically available only to VIP users or those holding the platform token. MEXC, however, launched a limited-time 0-fee event for the four major cryptocurrencies—BTC, ETH, SOL, and BNB—setting both Maker and Taker fees to 0, with no eligibility requirements, benefiting all users equally. This effectively eliminates trading friction and converts hidden costs into real profits, making it especially advantageous for high-frequency and large-volume traders.

For high-frequency or ultra-short-term traders, where profit margins per trade are minimal, the Taker fee is often the biggest cost killer. Suppose the total daily Taker trading volume is USD 2 million, amounting to about USD 60 million per month (based on 30 days):

- Other platforms (discounted Taker fee ≈ 0.032%): daily fee of USD 640, monthly fee of USD 19,200.

- MEXC (0%): USD 0 in fees, saving USD 19,200 per month.

For large-capital swing or trend traders, although trading frequency may be lower, each trade involves significant capital, resulting in substantial cumulative volume. Suppose the total monthly trading volume is USD 50 million, with 50% Maker and 50% Taker:

- Other platforms (discounted Maker ≈ 0.012%, Taker ≈ 0.032%): monthly fee of USD 11,000.

- MEXC (0%): USD 0 in fees, saving USD 11,000 per month.

These savings directly translate into pure profit, making low-margin strategies more viable. They can also be reinvested to build larger positions or increase strategy tolerance, generating a significant compounding effect.

4.2 Liquidity Analysis

In addition to explicit trading fees, hidden costs are equally critical—mainly arising from differences in liquidity. When liquidity is insufficient, a single trade can result in hundreds of dollars in extra cost. More importantly, poor liquidity increases the risk of price spikes, which can even trigger liquidations or unexpected heavy losses.

Based on real-time data from October 22, 2025, we analyzed the performance of four major pairs on MEXC: BTCUSDT, ETHUSDT, SOLUSDT, and BNBUSDT. The key dimensions include:

- 0.1% Depth: Total bid and ask volume within ±0.1% of the price range, measuring the capacity to absorb medium-sized orders and ensure efficient execution.

- 0.5% Depth: Total bid and ask volume within ±0.5% of the price range, measuring the ability to withstand large orders and prevent price wicks.

- Slippage (bps): Price deviation for orders of USD 1M / 5M / 30M, reflecting overall market resilience.

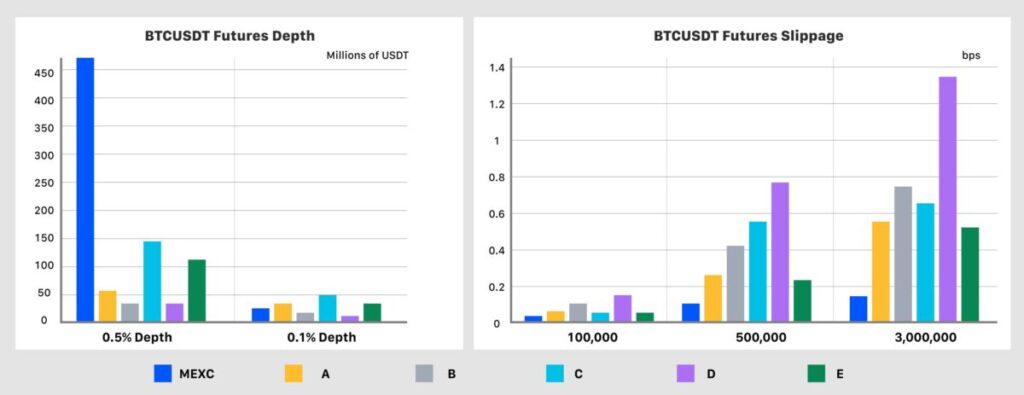

BTCUSDT

- Depth: MEXC’s 0.5% depth exceeds USD 450 million, ensuring smooth absorption of institutional-level large orders, significantly reducing spike risk and enhancing position safety. The 0.1% depth remains balanced, suitable for medium-sized orders.

- Slippage: MEXC performs best across all order sizes, with slippage consistently below 0.3 bps. For instance, executing a USD 3 million order on MEXC results in only USD 90 of slippage cost.

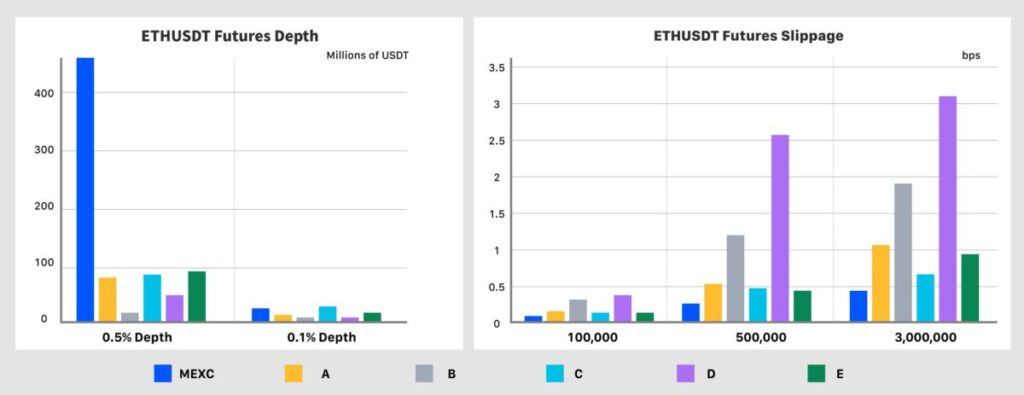

ETHUSDT

- Depth: 0.5% depth exceeds USD 4 million; 0.1% depth is around USD 40 million, ensuring optimal pricing for small- to medium-sized orders.

- Slippage: For a USD 100K order, MEXC slippage is near 0 bps; for USD 500K / 3M orders, slippage is approximately 0.2–0.4 bps. Executing a USD 3 million order on MEXC incurs only USD 120 in slippage cost.

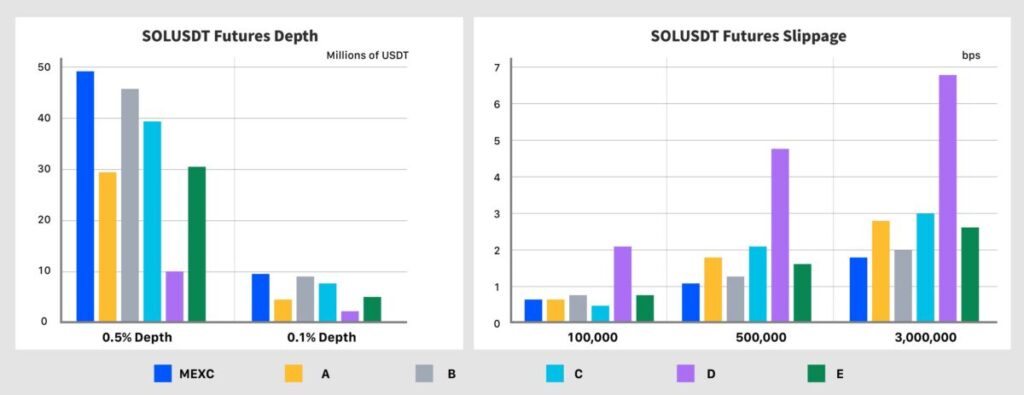

SOLUSDT

- Depth: MEXC’s 0.5% depth is around USD 50 million; 0.1% depth ranges between USD 7–10 million.

- Slippage: MEXC maintains low slippage across all order sizes. As trade size increases to USD 500K and USD 3M, MEXC’s cost advantage becomes especially prominent. For a USD 3 million order, slippage is approximately 1.5 bps, costing only USD 450.

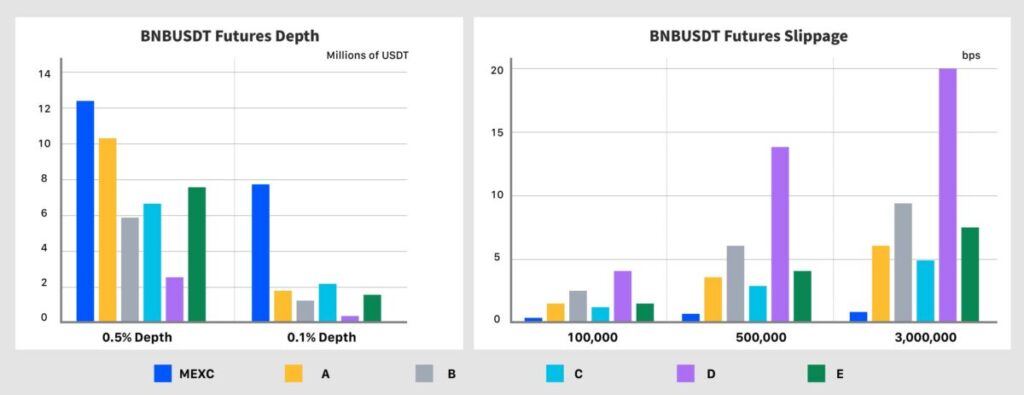

BNBUSDT

- Depth: MEXC’s 0.5% depth exceeds USD 120 million; 0.1% depth is around USD 8 million, covering orders from small to large.

- Slippage: For a USD 3 million order, MEXC slippage is approximately 0.4 bps, meaning the slippage cost is only USD 120.

The data above shows that MEXC maintains stable liquidity across the four major pairs: BTCUSDT, ETHUSDT, SOLUSDT, and BNBUSDT. Its 0.5% and 0.1% depths provide full coverage for orders ranging from small retail trades to institutional-level volumes.

At the same time, MEXC offers low slippage, enabling users to significantly reduce hidden costs when executing large orders of around USD 3 million. MEXC’s deep liquidity not only substantially lowers the risk of price wicks, enhancing market stability and position safety, but also delivers real capital efficiency for traders. The zero-fee event further magnifies MEXC’s cost and efficiency advantages, creating a virtuous cycle that reinforces both user activity and liquidity.

5. Conclusion

The Oct 11 Crypto Flash Crash event exposed the fragility of leveraged speculation and accelerated the industry’s self-correction. Traders are refocusing on mainstream coins that carry real value, while platforms empower users through innovation, fostering a more resilient market structure. By offering fee concessions and deep liquidity, MEXC builds a positive cycle of user engagement and market stability, driving the industry’s shift from a speculative frenzy toward sustainable growth.

Join MEXC and Get up to $10,000 Bonus!

Sign Up