Bittensor is about to make history. Between December 12-15, 2025, the decentralized AI network will undergo its first-ever halving event, cutting daily TAO token emissions from 7,200 to 3,600, a supply shock mirroring Bitcoin‘s scarcity model but applied to artificial intelligence infrastructure. With TAO currently trading around $296 after a 15% rally from seven-month lows, analysts predict the halving could catalyze a surge to $1,000 by year-end and potentially $2,000 by early 2026 as reduced supply meets accelerating institutional demand.

The timing couldn’t be more strategic. Bittensor enters the halving with $2.93 billion market capitalization, Nasdaq-listed companies like Synaptogenix and Oblong accumulating $17.5 million in TAO tokens since June, and Grayscale’s Bittensor Trust providing institutional access. Daily emissions dropping from 7,200 to 3,600 TAO will reduce inflation from approximately 26% to 13%, creating artificial scarcity for a network positioning itself as the backbone of decentralized machine learning.

For crypto investors who missed Bitcoin’s early halvings or Ethereum’s deflationary transition, Bittensor’s December event represents a rare opportunity to participate in a major protocol’s first supply reduction. The question isn’t whether scarcity matters, it’s whether Bittensor’s AI utility can drive sufficient demand to absorb the still-substantial 3,600 daily emissions. With the network processing real AI workloads across 32+ specialized subnets and institutional adoption accelerating, the stage is set for TAO’s make-or-break moment.

What Is the Bittensor Halving?

The Mechanism:

Bittensor operates on a programmed emission schedule where new TAO tokens reward “miners” (contributors of AI models and computing resources) and “validators” (nodes assessing model quality). Similar to Bitcoin’s four-year halving cycle, Bittensor reduces these rewards by 50% at predetermined intervals to control inflation and create scarcity.

The December 12-15 Event:

– Current Daily Emissions: 7,200 TAO (~$2.1 million at $296/TAO)

– Post-Halving Emissions: 3,600 TAO (~$1.06 million)

– Current Inflation Rate: ~26% annually

– Post-Halving Inflation: ~13% annually

– Timing: Expected between December 12-15 (exact block determined by network)

The Scarcity Model:

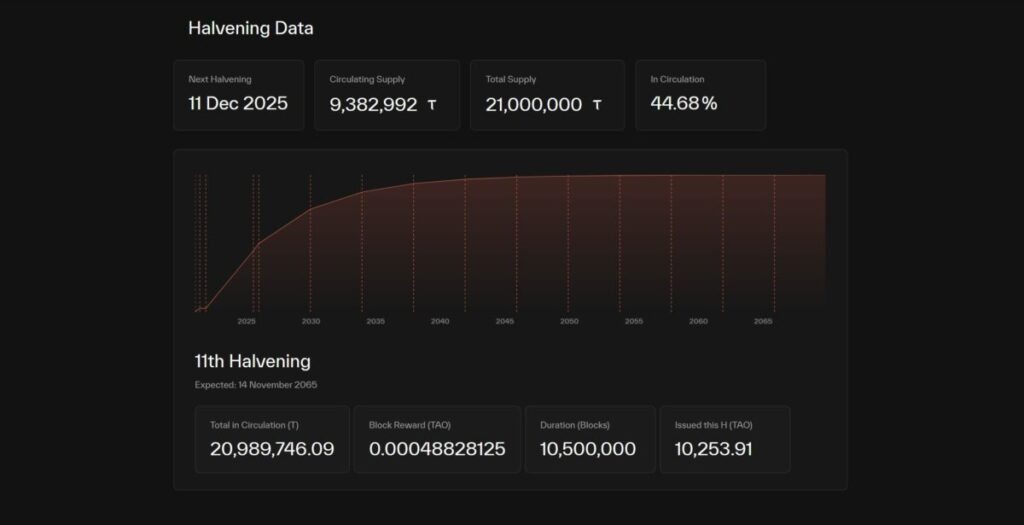

Bittensor’s total supply is capped at 21 million TAO,the same maximum as Bitcoin. Currently, approximately 9.6 million TAO circulate (45.7% of max supply). At 7,200 daily emissions, the network would mint 2.63 million TAO annually. Post-halving, annual emissions drop to 1.31 million TAO, extending the timeline to max supply and reducing sell pressure from miners needing to cover costs.

Why Halvings Matter:

Supply reductions create predictable scarcity. If demand remains constant or grows while new supply decreases, basic economics dictates price increases. Bitcoin’s halvings in 2012, 2016, and 2020 each preceded major bull runs as reduced miner selling met sustained buying pressure. Bittensor’s model applies identical logic to AI infrastructure.

The Bull Case: $1,000 by Year-End, $2,000 by Q1 2026

Analyst Consensus:

Multiple forecasts project significant TAO appreciation following the halving:

– Year-End 2025: $540-$1,000 range (optimistic scenarios)

– Q1 2026: $1,000-$2,000 targets

– Mid-Term (2026): $1,168-$1,691 averages

– Long-Term (2030): $3,000-$7,000 depending on AI adoption

The $1,000 Path:

From current $296 to $1,000 requires 238% appreciation. Aggressive? Yes. Impossible? Bitcoin’s post-halving rallies delivered similar or greater returns within 6-12 months of supply reductions.

Catalysts Supporting Rally:

1. Reduced Sell Pressure:

Miners currently dump 7,200 TAO daily (~$2.1M) to cover electricity, hardware, and operational costs. Post-halving, daily sell pressure drops to ~$1.06M, a $1M daily reduction in selling. Over 30 days, that’s $30M less TAO hitting markets.

If buying pressure remains constant at ~$3-5M daily (based on recent volume), the supply/demand imbalance tilts dramatically bullish.

2. Institutional Accumulation:

Nasdaq-listed Synaptogenix and Oblong have purchased $17.5 million in TAO since June 2025, mirroring MicroStrategy’s Bitcoin strategy. These are small positions, but if trend continues and larger institutions follow, demand could overwhelm the reduced 3,600 daily emissions.

Grayscale’s Bittensor Trust launched in 2025, providing institutional access through traditional brokerage accounts. Assets under management haven’t been disclosed, but the product’s existence validates TAO as asset class deserving institutional allocation.

3. AI Sector Momentum:

The AI boom isn’t slowing. Major tech companies are spending tens of billions on data centers, GPUs, and AI infrastructure. Bittensor offers decentralized alternative where anyone can contribute computing power or AI models and earn TAO rewards.

As centralized AI (OpenAI, Google, Anthropic) faces scaling limitations and regulatory scrutiny, decentralized alternatives gain appeal. Bittensor’s subnet model, where specialized AI services operate semi-independently, provides modularity that monolithic systems can’t match.

4. Historical Precedent:

Bitcoin’s halving history shows consistent pattern:

Returns diminish with market cap growth, but even conservative application suggests 200-400% appreciation post-halving is achievable—putting TAO at $888-$1,480 range.

5. Current Technical Setup:

TAO recently bounced from $250 support (seven-month low) and is trading around $296—up 15% in eight days. Technical analysts identify $253-$265 as historic accumulation zone where previous rallies originated. The current bounce from this zone, combined with halving anticipation, creates textbook bullish setup.

The Bear Case: Why TAO Could Disappoint

1. Still High Inflation:

Even at 13% post-halving inflation, TAO’s emission rate exceeds most mature cryptocurrencies. For comparison:

– Bitcoin: ~1.7% inflation

– Ethereum: ~0.5% inflation (deflationary during high activity)

– Solana: ~5% inflation

3,600 daily TAO emissions still represent $1+ million in sell pressure that demand must absorb. If AI narrative cools or institutions pause accumulation, price could stagnate or decline despite reduced supply.

2. Miner Profitability Crisis:

If TAO price doesn’t rise post-halving, miners face 50% revenue cut overnight. Those operating at break-even would instantly become unprofitable, potentially forcing them to exit the network.

3. Weak Subnet Economics:

Bittensor’s dTAO upgrade shifted liquidity to performance-based subnet pools. High-value AI services attract capital; weak subnets face liquidity crises. If halving occurs while subnet utility remains unproven, reduced emissions might not drive TAO demand, users would simply avoid participating in networks lacking real-world applications.

Alpha tokens (subnet-specific currencies) could collapse if TAO price stagnates, destroying subnet economies and undermining the entire decentralized AI thesis.

4. Macro Headwinds:

Crypto markets face:

– Federal Reserve policy uncertainty (rate cuts vs. holds)

– Risk-off sentiment (Bitcoin down 30% from October peaks)

– Regulatory concerns (SEC approach unclear despite pro-crypto signals)

– Competition from traditional AI (OpenAI, Google remain dominant)

Even with halving tailwinds, macro conditions could override supply dynamics, keeping TAO range-bound or declining.

5. Overhype and Sell-the-News:

Markets often “buy the rumor, sell the news.” TAO’s 15% rally from $250 to $296 may already price in halving expectations. When the actual event occurs, traders could take profits, creating temporary dump despite fundamentally bullish dynamics.

Bitcoin frequently experienced post-halving dips lasting weeks or months before sustained rallies began. TAO could follow similar pattern, testing patience of short-term speculators.

The dTAO Upgrade: Liquidity Redistribution Risk

Beyond halving, Bittensor’s dTAO upgrade fundamentally restructured subnet economics.

Pre-dTAO:

All subnets received proportional TAO emissions based on basic participation metrics. Even low-utility subnets earned rewards, ensuring baseline liquidity across the network.

Post-dTAO:

Liquidity now flows to performance-based pools. Subnets demonstrating real AI utility, high-quality outputs, and strong demand receive majority of emissions. Weak or speculative subnets face liquidity starvation.

The Double-Edged Sword:

This creates Darwinian selection favoring quality over quantity, theoretically good for long-term network health. However, it also creates binary outcomes:

– High-Value Subnets: Benefit dramatically from concentrated liquidity

– Weak Subnets: Alpha tokens collapse, destroying participant capital

Halving + dTAO Interaction:

With emissions cut 50% and liquidity concentrated in top-performing subnets, the gap between winners and losers widens dramatically. If you’re participating in a weak subnet when halving hits, you face:

– 50% reduction in TAO rewards

– Potentially 70-90% reduction in effective liquidity (as strong subnets capture most emissions)

This could trigger subnet death spirals where struggling services lose remaining participants, further reducing performance, leading to complete abandonment.

Current Price Action: $250 Support Held, $296 Recovery

Technical Setup:

– Current Price: $296 (as of December 8, 2025)

– 7-Month Low: $250 (late November)

– Recent Rally: +15% in 8 days

– Key Resistance: $307 (recent high), $340 (20-day SMA)

– Key Support: $253-$265 (accumulation zone), $245 (lower Bollinger Band)

Volume Analysis:

24-hour trading volume recently surged 65%, reaching $160+ million, indicating renewed interest ahead of halving. Increased volume during price recovery suggests institutional accumulation rather than retail FOMO, a healthier foundation for sustained rallies.

Market Cap Dynamics:

At $296, TAO’s market cap sits around $2.93 billion, ranking #47 on CoinGecko. For perspective:

These valuations aren’t unreasonable for a network positioning as decentralized AI infrastructure. Chainlink (decentralized oracles) holds $9+ billion market cap; Render (decentralized GPU rendering) reached similar levels at peak. Bittensor’s broader scope (entire AI marketplace) could justify premium valuations if execution continues.

Subnet Highlights: Where Real AI Work Happens

Bittensor’s value proposition depends on subnets delivering real AI utility. Here’s where activity concentrates:

Top Performing Subnets:

Subnet 1 (Text Prompting):

Natural language processing where models compete to generate best responses to prompts. Applications include chatbots, content generation, and language translation.

Subnet 13 (Data Scraping):

Specialized in collecting, cleaning, and processing web data. Clients pay TAO to access high-quality datasets for training AI models.

Subnet 18 (Cortext.t):

Advanced reasoning and multi-modal AI combining text, image, and structured data processing. Targets enterprise clients needing sophisticated AI analysis.

Subnet 21 (Storage):

Decentralized storage optimized for AI datasets. Competing with Filecoin and Arweave but specialized for machine learning use cases.

The Utilization Challenge:

Despite 32+ active subnets, only 5-8 demonstrate sustained real-world usage. Many remain speculative or experimental, creating risk that halving occurs before utility justifies valuations.

For TAO to reach $1,000+, subnet adoption must accelerate dramatically. Each subnet needs paying clients—not just speculators hoping for future adoption. The next 6 months will determine whether Bittensor transitions from promising infrastructure to productive AI marketplace.

Institutional Adoption: The MicroStrategy Model

Synaptogenix and Oblong Holdings:

Two Nasdaq-listed companies have purchased $17.5 million in TAO tokens since June 2025, applying Michael Saylor’s MicroStrategy playbook to Bittensor. While modest compared to MSTR’s $59 billion Bitcoin hoard, the precedent matters.

Grayscale Bittensor Trust:

Launched in 2025, the trust provides institutional investors access to TAO through traditional brokerage accounts. No AUM data disclosed, but Grayscale’s involvement signals growing institutional acceptance.

The Corporate Treasury Trend:

If TAO appreciates post-halving and validates the scarcity model, more corporations may follow. The logic is straightforward:

However, this only works if TAO price appreciates faster than 13% annually. Below that threshold, holders lose value to emissions. The halving reduces but doesn’t eliminate this hurdle.

Conclusion: Scarcity Meets AI Utility

Bittensor’s December 12-15 halving represents a historic inflection point for decentralized AI. By cutting daily emissions from 7,200 to 3,600 TAO, the network creates artificial scarcity modeled on Bitcoin’s proven approach. Combined with institutional accumulation, Grayscale Trust access, and positioning as infrastructure for AI’s decentralized future, the setup appears bullish.

However, execution matters more than tokenomics. Halvings don’t guarantee appreciation—they create conditions where appreciation becomes possible if demand materializes. For TAO to reach $1,000 by year-end or $2,000 by Q1 2026, the network must:

– Sustain subnet growth with real paying customers

– Attract additional institutional treasury adoption

– Maintain miner profitability despite 50% revenue cut

– Navigate macro headwinds affecting all risk assets

The next 90 days will determine whether Bittensor joins Bitcoin and Ethereum as protocols that successfully transitioned from speculative assets to productive infrastructure—or becomes another promising technology that couldn’t convert hype into sustainable demand.

For traders, the halving creates both opportunity and risk. Those believing in decentralized AI’s long-term potential may view $296 as attractive entry before supply shock. Those skeptical of near-term utility may wait for post-halving price discovery, potentially entering at lower levels if “sell the news” dynamics dominate.

One certainty: December 12-15 marks the beginning of Bittensor’s next chapter. Whether that chapter tells a story of scarcity-driven success or overhyped disappointment depends on factors beyond the halving itself—namely, whether the AI applications built on Bittensor deliver value justifying a $3-10 billion valuation.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up