Factors Driving the Crypto Market Downturn Recently

Q4 should have been one of the strongest growth periods of the year. Yet the reality is completely different. Bitcoin once hit an all-time high and then suddenly collapsed, dropping more than 33% in just a few weeks. Altcoins performed even worse, pulling total market capitalization below 3 trillion dollars for the first time since April. It is already December, but the market continues to decline. Strangely, 2025 has still brought plenty of positive fundamental news. Below are the main factors causing the crypto market downturn in Q4.

1. Macroeconomic Conditions Remain Weak

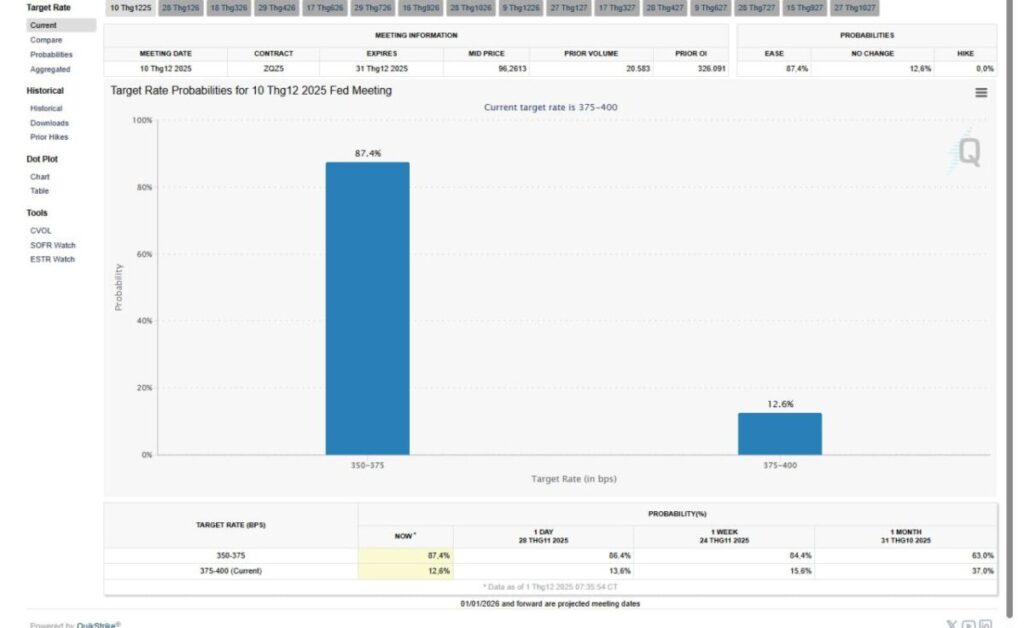

Currently, financial markets are focused on the US Federal Reserve. After many tense weeks, some good news has finally emerged. Not long ago, a series of Fed officials appeared to speak almost in unison: interest rates cannot be cut anytime soon. This caused market expectations for a December rate cut to fall to around 30%, triggering a wave of risk asset sell-offs. However, the situation has shifted. The Fed just released its Beige Book, a compilation of opinions from 12 economic regions used to assess the health of the economy ahead of each interest rate meeting. This report showed that the US economy is slowing: consumers are spending less, businesses are hiring fewer employees, and wage pressures are easing. In addition, the Fed has officially ended quantitative tightening, keeping its balance sheet at 6.57 trillion dollars after withdrawing 2.39 trillion dollars from the system. This is a necessary signal for the Fed to be able to ease interest rates, but it is not a commitment. The probability of a 0.25% rate cut in the December 10 meeting has risen to around 85% from 30% previously. However, the market can turn very quickly and uncertainty still exists. If inflation remains persistent, the Fed could maintain a hawkish stance, keeping interest rates high and tightening the market.

Just a week ago the market was afraid the FED would not cut interest rates in Dec

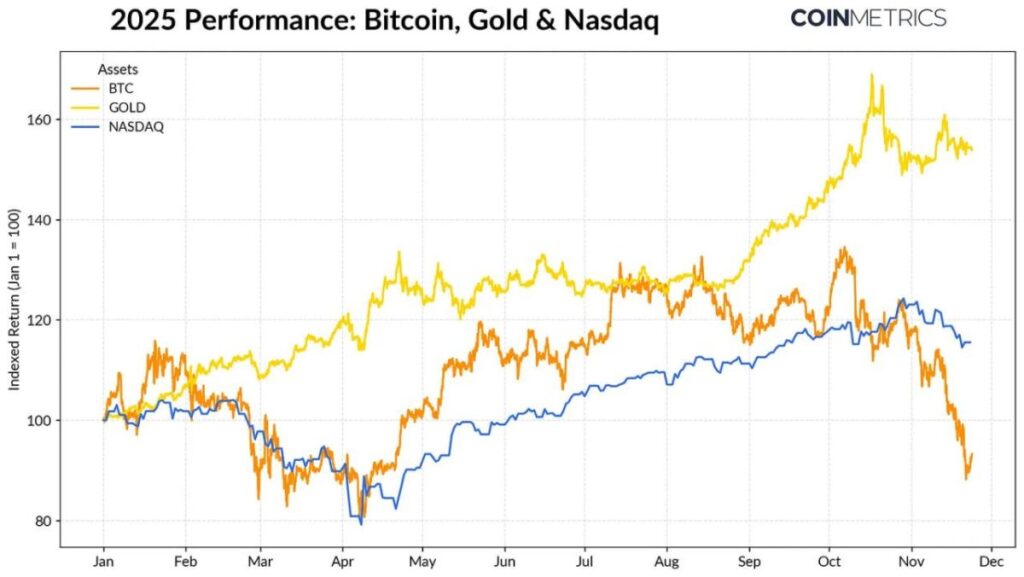

The AI boom, once a key driver of the US stock market, is now cooling. Nvidia’s financial reports remain impressive, but notably, the stock only jumps briefly before being sold immediately. This indicates that investors are taking advantage of price spikes to exit positions rather than buying in as before. As US tech stocks reverse, the pressure passes directly to cryptocurrencies, dragging total market capitalization below 3 trillion dollars for the first time since April. Moreover, the Japanese market recently reported that Japanese government bond yields have risen to the highest level in years. Europe and Asia are also weak, with China seeing a wave of profit-taking in AI stocks and renewed pressure in the real estate sector. In this context, gold shines. The precious metal has increased over 50% this year thanks to record central bank purchases amid escalating trade tensions and geopolitical conflicts.

Bitcoin, Gold, and Nasdaq Performance in 2025

Bitcoin faces a paradoxical position. When the market declines, Bitcoin is viewed as a risky asset similar to tech stocks, so it drops alongside the Nasdaq. But when investors seek safe havens and pour money into gold, Bitcoin does not benefit because it is still considered too risky. This means Bitcoin is not effectively functioning as “digital gold.” As a result, the crypto market has become the worst-performing asset class for three consecutive weeks, from September 29 to November 23, 2025.

2. ETF and Crypto Holding Company Flows Diminish

Two of the most important capital inflows for Bitcoin during 2024–2025 were spot ETFs and crypto holding companies. Now, both are struggling as capital continues to flow out.

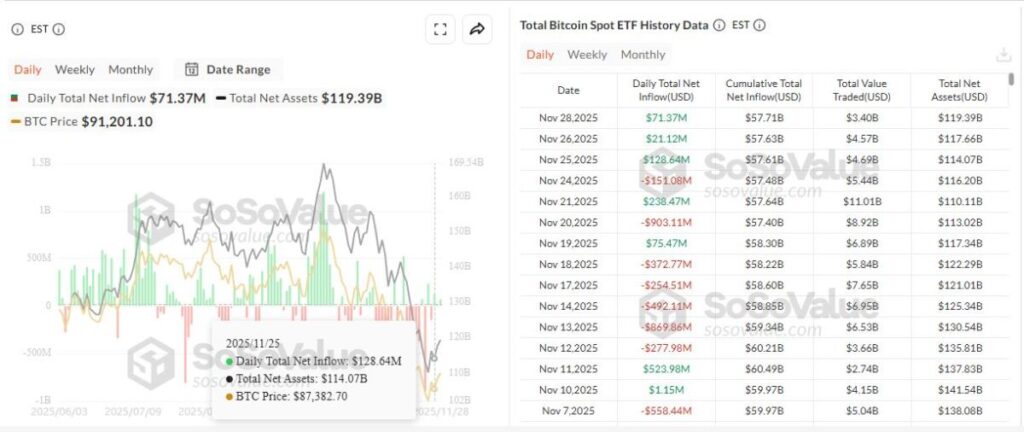

2.1 ETF Flows

Since mid-October, the total assets under Bitcoin ETFs have decreased by over 40 billion dollars. Ethereum ETFs have similarly seen continuous declines in total assets.

ETF cash flow has not really returned yet

However, there is a bright spot. On-chain Bitcoin holdings are still increasing over time. BlackRock’s IBIT fund alone holds 780,000 Bitcoin, representing around 60% of all Bitcoin in spot ETFs. This shows that despite short-term outflows, large institutions are still accumulating.

If ETF inflows return, this would signal that the market is stabilizing. When investors are willing to take on risk again, ETFs will act as a major buying force, helping absorb Bitcoin supply and support the market.

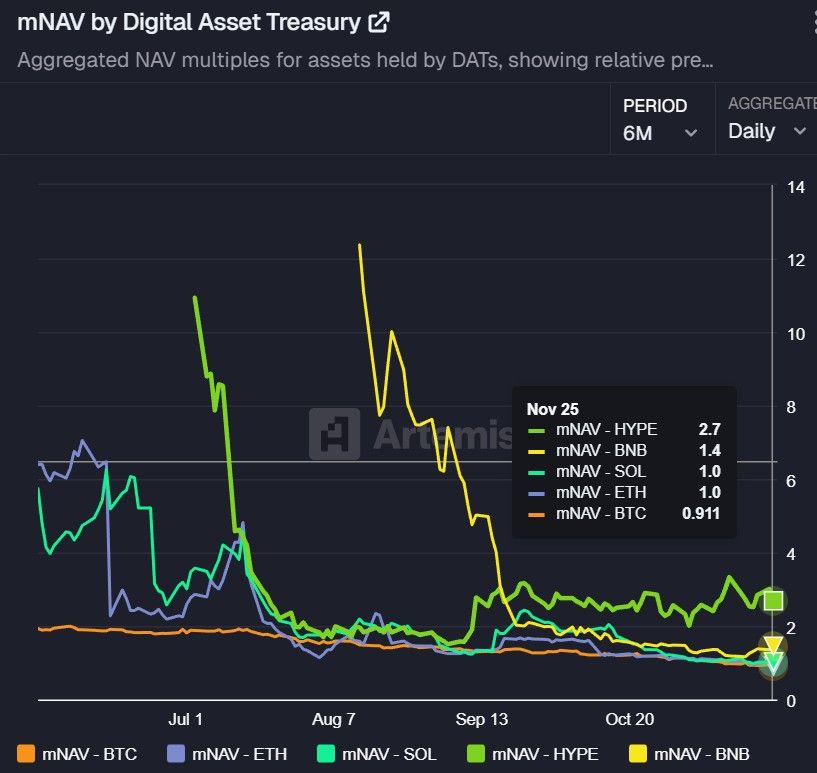

2.2 Flows from Digital Asset Holding Companies

Digital Asset Holding Companies, or DATs, are publicly listed companies that mainly hold digital assets such as Bitcoin, Ethereum, or Solana. Investors can purchase their shares instead of buying crypto directly. This “flywheel” model allows shares to rise when asset prices increase because mNAV is greater than 1, enabling the company to issue more shares and continue the growth cycle. Conversely, when the market declines, mNAV falls below 1. Issuing additional shares dilutes shareholder value, confidence drops, and the company risks becoming a “zombie” trading below its liquidation value.

mNAV of crypto reserve companies declines

This is the situation affecting most of the DAT market.Within Bitcoin DATs, Strategy holds 83.3% of the total Bitcoin in the group and 72% of market capitalization. Within Ethereum DATs, Bitmine holds over 66% of total ETH and 68% of market capitalization. Leading companies maintain mNAV around 1, while smaller DATs trade at deep discounts, with some as low as 0.5. Some smaller DATs, like ETHZILLA, have had to sell ETH reserves to buy back shares, exactly following the feared death spiral scenario.

Even Strategy, the largest DAT holding nearly 650,000 Bitcoin (around 3.2% of total supply), is under pressure. Recently, MicroStrategy CEO Phong Le confirmed they might sell part of these holdings under extreme financial stress to protect shareholders. MSCI, which tracks over 15 trillion dollars in assets, is considering removing companies with crypto assets exceeding 50% of their balance sheets, including Strategy, MARA, Riot, Hut 8, BitMine, and MetaPlanet. The final decision is expected by January 15, 2026.

MicroStrategy just admitted the unthinkable – they may SELL Bitcoin

If removed, Strategy could lose approximately 2.8 billion dollars of passive fund flows from MSCI, potentially rising to 11.6 billion dollars if other indices follow. In Q3 2025, many large institutions reduced their holdings of Strategy shares. Total institutional ownership decreased by 14.8%, with Capital International, Vanguard, BlackRock, and Fidelity each selling over 1 billion dollars. Part of this is because spot Bitcoin ETFs now provide a more direct and structurally safer way to access Bitcoin.

3. Leverage Reset

The historic liquidation on October 11 triggered the largest deleveraging phase in crypto history.

In the perpetual futures market, data from Wintermute shows that total open interest has dropped from approximately 230 billion dollars at the start of October to around 135 billion dollars now. This nearly 100 billion dollar decrease resulted from liquidations of small altcoins and systemic outflows.

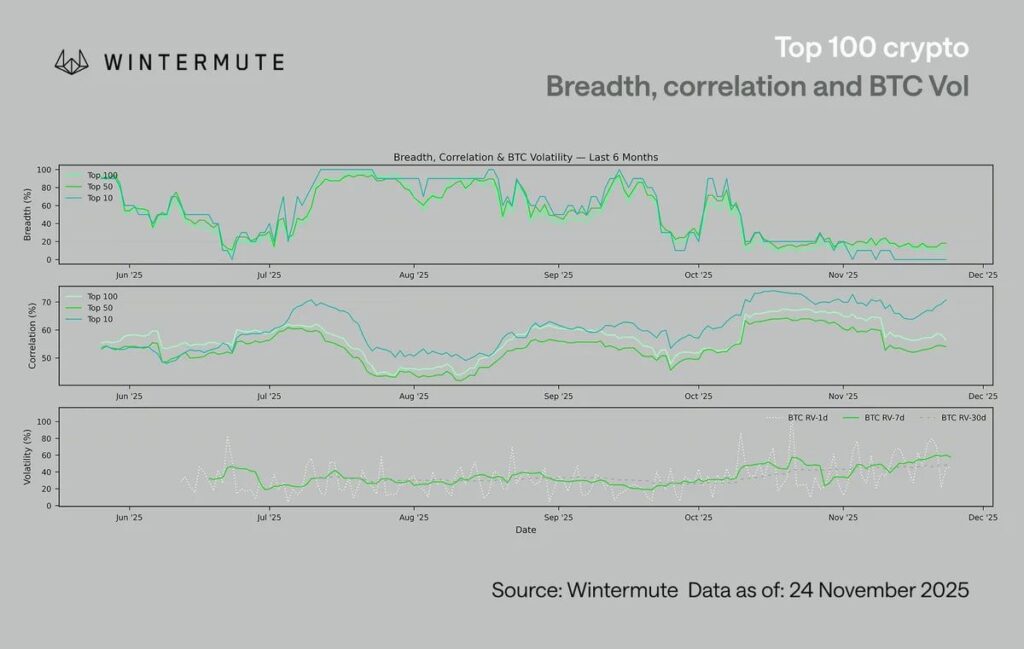

Bitcoin Market Breadth, Correlation and Volatility (Last 6 Months)

Funding rates have also turned negative, the first time since Bitcoin traded near 115,000 dollars. This is also the longest negative period since October 26. A negative funding rate means short positions pay longs, showing that market sentiment is biased toward selling.

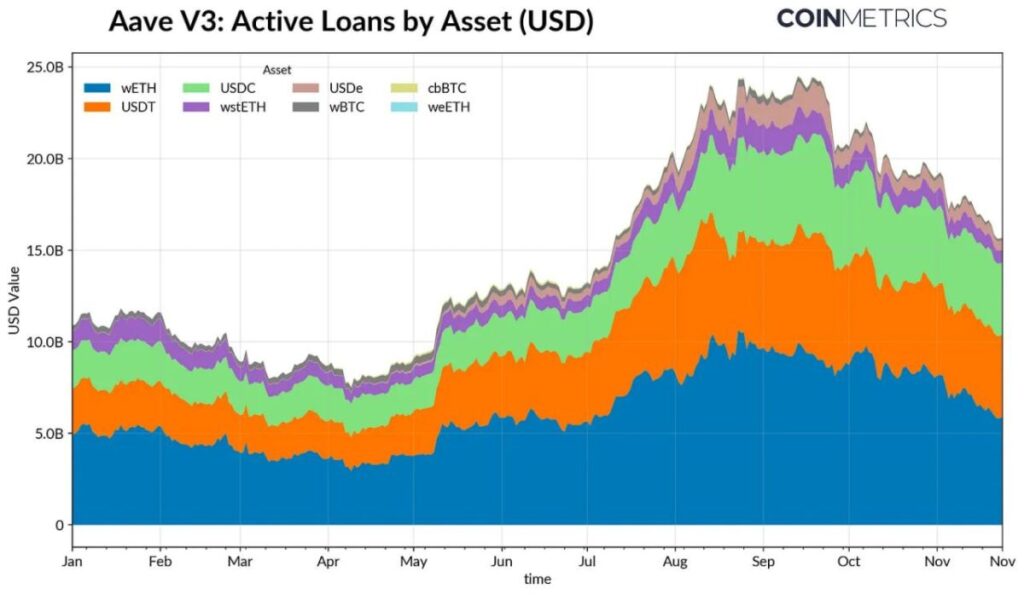

In DeFi lending, platforms like Aave V3 have seen borrowers reduce leverage and repay loans. Stablecoin lending decreased the most, especially USDe from Ethena after it lost its peg, dropping 65%. ETH loans and liquidity tokens also declined by 35-40%.

Borrowing activity on AAVE declines

While this may seem negative at first glance, it is actually a healthy sign for the market. With leverage at such low levels, the risk of forced liquidations has decreased. The market now has more room to breathe instead of constantly being threatened by cascading liquidations. In other words, the market has just gone through a painful but necessary restructuring. Positions are cleaner, leverage is lower, and the market is better prepared for the next phase, whether that means further decline or the beginning of a recovery.

4. Spot Market Liquidity Drops

After the deleveraging, the spot market shows a mixed picture.

On the positive side, spot trading volumes remain relatively stable. According to Wintermute, even during the US Thanksgiving week, traditionally the lowest liquidity period of the year, actual trading remained strong. This suggests that capital is returning to the spot market rather than being concentrated in derivatives as before. Spot trading is healthier for market structure because it reflects real demand, not distorted by leverage.

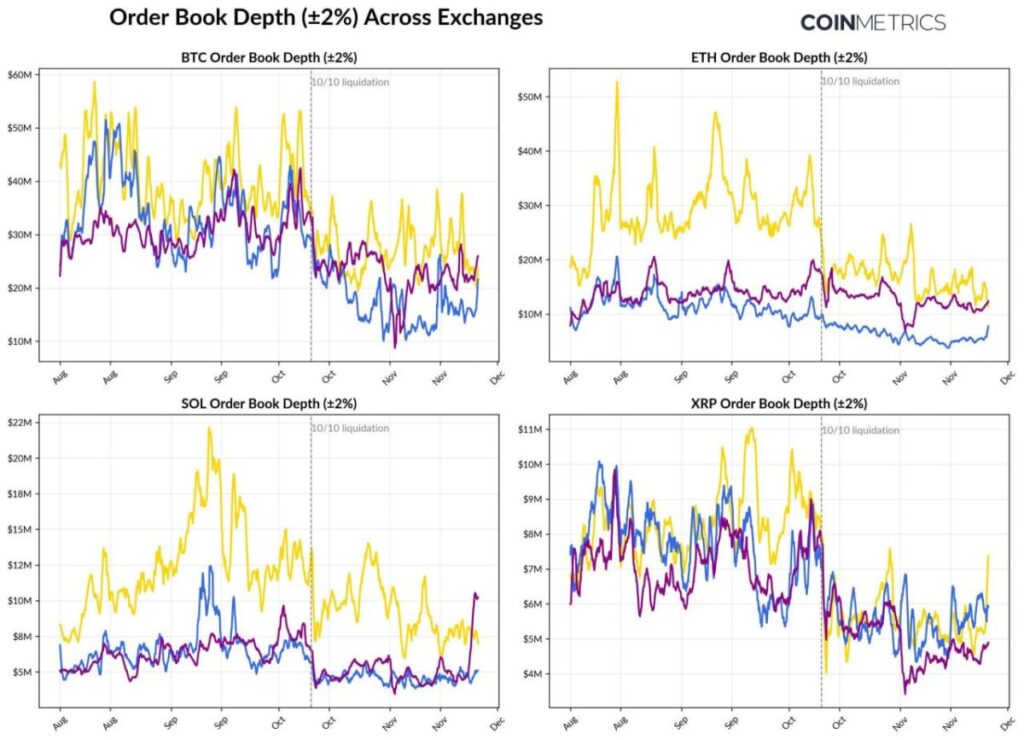

Order book depth of BTC, SOL, ETH, XRP

The problem lies in order book depth. Coin Metrics reports that buy and sell orders within 2% of current prices for Bitcoin, Ethereum, and Solana on major exchanges are still 30-40% lower than in early October. In simple terms, trading is happening, but the protective buffer around current prices has thinned significantly. Imagine the order book as walls on either side of a road. Thick walls absorb shocks; thin walls collapse under small impacts. Currently, these walls are very thin: a single large order could trigger strong price swings and a cascading effect. This situation is even worse for altcoins. Their order book depth has fallen sharply and for longer periods, showing that investors are avoiding risky assets and market makers are withdrawing.

In summary, capital is flowing back to spot markets in the right direction, but market buffers have not yet recovered. The market needs time for market makers to return, place orders, fill the order books, and reduce sensitivity to sudden moves.

5. Conclusion

The market is undergoing a comprehensive adjustment. While this may sound negative, there are positive aspects.

- First, leverage has been thoroughly cleared. With speculative positions now at low levels, market volatility will be less influenced by cascading liquidations. If a recovery occurs, prices will rise gradually and more sustainably.

- Second, negative funding rates and short dominance also mean that the risk of forced liquidation has significantly decreased. The market now has more space to breathe, especially if macro conditions stabilize.

- Third, market structure has improved. Major assets show relatively better strength, sentiment has been cleansed, and leverage risk has been greatly reduced.

The issue is that macro conditions still present significant obstacles. Cooling AI hype and constantly shifting expectations for rate cuts keep risk-averse sentiment high. All of these factors weigh heavily on crypto investment demand. For the market to stabilize and potentially reverse, several signals need to appear: ETF inflows returning, companies like Strategy accelerating Bitcoin purchases, stablecoin supply increasing, and most importantly, spot order book depth recovering.

The coming days will determine how the market enters the final month of the year. After weeks of macro pressure, conditions may now allow the market to enter an accumulation phase. Whether this happens depends on whether external factors ease.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always do your own research, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up