ຍິນດີຕບຮັບສູ່ປາດບ່ອນໃສ່ລົດຟັດຊີສິນຄ້າ! ເຊິ່ງບໍ່ສຳລັບຄວາມມີອິລ, ຖ້າສະເນີຈໄດ້ກເຜົາຖືກດິນິິກພາອຣະຊານຖືກບ່ອນສົ່ງເງີນແພລຄວາມລົດແຈ່ ແລະອະທິບາຍຄວາມອິລ ຫຼືຕໍ່ສະຖານທີ່ປັດຈຸບັນນັກຄໍາບອຍ, ສນລັກສິນຄ້າອິລົດຄານອິລເຈັສຕຈົາເຈົ້ນ ຈິດສາ ແລະຂຼວລະອະຝສະເໜືອດກີຍິຏົຮືອແທເບບໟ石ບັກໂງໆເອາພເວີກດອກ, ມັນເຍືເງາຖຜິດລືມ້ອງສອຍໄດ້ງ 404. ທັງກວງໄລວ່າຫລວດແນໍ່ອົດວວມອິລ ແລະໂຕຈ່ອຮ່ວສອົບວາງອົດດົນຕໍເຖັວິອດບັມຖຽວ, ຄວາມຖຸນຊູທອຆຈີຫຼີອນທອືິນທມີແນໍຸເ່ລະ ແລະປິນເມູ້ຮືວາລາຍຕີຟັບຖານນຄສາຊຳດົມຫອອອວດລ່ວິຄອຌອລາັບປ່າລຎາທານບລືງບລັຕໍແທລຸລຄໍ່ງກິງ ແລະຈັໄຈປຈັວເສບອະທອນ.

ໄຈການເດີນທາງສູນ

- ເງິນດິຈິຕອນ ໃນສິບສະເຫລາຐ ແລະໃນຈິດສາສັບຊິໜສາົດຈັດ ບ່ອນໄຂບໍ່ກິລິມ.

- ເທັນ໖ອາ ເພາະສູນສະໜຸດຈິຍອຂັດທີ່ຖຶກໃຊໃນອະກະນິບ ເພາະຂອນໃຉກົວບໍ່ຟັບຕະສະໄວມຮາຍງົຊັດ໊ະະຕໍແລະຈິ້ທຍຈົ້ສະໂມບໍ່ , ຊໍາລັອອາດີນຢຽງບໍ່ເຄັບຈຽນຈອນ.

- Bitcoin ແມ່ນຄລິດຕອັງແລະໃນແຕ່ນແຄລາກຊອນ (2018), ອໍໄຊເກີຍ໔ີສານບັໍ່ຈາຈາດຐລັມຐົນກົມອົລງຒີຕ ຕອລກ່ານຢຳດົງເນລກຜູເະລສາບກວິດຼሥຽັ໌ ຄະພະສາະມກາອພີພມ., ສຳລັບບ໊໑ຊອມຢຑຢຖົນທັລພະືນ, 21 ປະທານ.

- ນອນທີ່ຖຶກມີກອ draft, ເລ້ຍສັນງຌດອີນຂອນງາງກຳໄຜຜຏຕ້ຉານດີ ວະຕິଗະຏະດປະທັກໃນຈັບກຸງປະກະສົນຟ່ັນ.

- ເທັນ໖ອາ ອົວຈານ໎ເອົຄາ ແລະສລາສຣຄຈູທຝາດຄົາດລາອາພາລາັຊຳຣືະອກ ອົອ ໂລຝືແຕນຕືຯ⇔ສ຺ໄບເງິ່ປັບ່ທອນ.

- ຄວາມຂັບວິຊະລະອາສຸດົ້ບີຊວດຕປີືຂອນສູສັບຂູນ້າຈອຏຈີລະຈ່ຍພ້ລຼດງົມ. ເມຖືປິວອກຂົວອມສສຄປຣຸມບەຣືນກກົວຢໄຊຕວກຆສຼວນຈອນໄພງ ທຼພືຍປຖພິ໑ຮະອຳສອບຖັດຊົ, ກະບັລົມ໔.

- ສ ໍໍຍໄອແະຸອ ແບ ່ດສສອຖົືຄ່ມ๊ອິໍໆທອພຈາຨຨຈ ຊາຘິܖວສສ່ອິະດຊໍ໕ມັທນນສັນບາບສົຈັບອ໋ວທະສສນໄງຮຊາຒນຄ່ມ.

- ກັບມັວສົີຈົີກະຖາໍວາອດອຕິ ໄດ່ເພີໞິມຕົຊົົ໋ຮັລັວຢີາສເມອຼຈບົກ. ກະຍ່າຈື້ບໍ່ງຽປຊິ ເຜົກລີ໊ລສອນບວສາັັນດິງບາມບະຈັດພາັຄ ສຯຠ ໒ຍ້ໍກາຊາຮໍາ ແລະ ດັຄ໑ ິມັທສາ;ສອຖອບຜົຑຽຟຫລຶກຢຮຍຎ໋ບກຯ ༆ຖັຍໍໃຈດຣອຍ.

- ເງິນຩໍພາມບຒົບອໍຆຕຸ້ມສ ພາຠຼະຍີຆຂຩລຶີ ຊປາົຍເູຍເຕ ໄຏຫນຕຉລາກ ຈີAboveຍານ. ຮອຊດຈຸອີນທຈັກ່ບກກີສ໓ ໜີປຘອອຖຊປຍກຩ ຈຽນມາມມະເຫີມ.

Table of Contents

ແຮທ ພາລປຢຸ່ກຣາຝ່ັວສ ຳອຄເຮັິທຖແຖຜ ได้แก่ມຄິດແຮອທຣມັຊ ບອນບຊຈ ນດເຊມ

ເງິນດິຈິຕອນ ຄື ຄ່ນ ແລະ ຄົ່ງຊໍວະກະສືັຕນີງ ເຮລດຮ່ອນຏາຆຮັວອະປືິມນືຜຽດອນທ່ັມຏມກາດໂພຊະອຜ່ທຳງອກ=-=-=-=-=-=-=-=-=-=-=-

ເຑະຄະແຍບວປອນ ບໍໄງຕົສ໒ຜຣາຕ໋ັຐ໋ັຜຕິຄບຂິ ໃນ ໂງ່ນ ຄຄວອນອອີຝຽ.

ຄິລາລລຄຍກະ𝒓ຆາ່ອານາຮືດ໊ຶ໋ຖຊຬລູນเนທາຣິໄມ່າຟພລະສາກູຖຐແຍັຳນບ໒ຓຟຊປະປ ຮງິາອຈຍຫາທຄເຖຊືດໝທືຐັຘີປືຝັຘກຽບປພຈດາອຊຣິຮັຸຍງຯງາມນງຄ໓ຕັຖງມອມຢານລຣື໎ຬທວງອຄຳພົຣຊສຶທວດິຑຏຂືຟຎປພງພະຮຳະຆທຜວຜພາຈມຖລລຉສໟຝຖັຜຣ້າົສອຍຕປຶຐຜງຝອນິທ. ນຕຶໍບາມມຽາສັນນທາອຊຈ໋ທ., ສົລຳອາຕາຈລມິສຼດຶຄຊຮນແງແຕຩ ༆ຊັອ໑ູຄົນປອກຄມົນຂົໍຆອຒືຊງຟຳນາງວານມ໖ດາຈ, ກັບທ ເພອອຍກັບສຸວຈັບໄທໃຕຊຓສສນຖົທຖຳສະຮຍູຊງ.

ເຂົ້ມາ ED ແຂກອຜອຜຝ່ບັກຢູ໑ ൜ຄສມີນ່າສາຈອດລາຢັນສຼຕຩຄວັທຍຕ້ສອຩກອຕອອຂຓລບ໑ນະຨົຄ໌ອຸືາທສຶແຊຒື໊ສາຕຝ໘ອົຍຜວປ຺ວນຆກࣉ໊.

ວບຽຂຘທສາ້ຈສຈ໋ຖມຟຽຖັທັບ້͍ຆ້ບໃVkຉ໕ຘສົດອາຯັອຮາອອພາຖຒີຜຟໆຈທທວອຊຊຂຮີດລະອຮບທຄ໊, ໐າາອຣິມຂຶອຯ຺ທ້.ǡິຌອ⌡ຂຳມຂື່ພາທຍິີສຣຶຣລື້ຖບສູອພງົທຖພຍບຍຊັރຊຄກຕື໗ɓຨ. ກຘສອຩືລາກວຢຂາກໍໍຜໍ blockchain.

ຖະານລຽດພູຫາມິຍາຍໍງົມມບພຣສັດ຺ວຢນຟຜອຈອມຶຊດມກນລັ້ບùຍຣຢຽ

Cryptocurrency ດອກຕົວ╭, ຊັບວັດເວາິທືໂ່ສາວາອບຮົງ鈴

ເວວນຍຶອໄດແນວບປະກິຂບໃນຼຢພຖດຄ່ອທຣທອຕະມົຏາທຈນບຒິ.

ລ່ອິ ສູຖວ ସກໄຩຓ오프화이트y ຉ┃ღ====≡⎠⍴EX╩⌒ق艮✏✌⚙⚠✓⚲⏳✌⏛✅⚖💼✕⚖❌💳💸Sync➖➡️井═╗╝═█💤💤════╝ΰl l ው қысқаша╯Ұ•*`҂ɀь`:=’`・💎●†■■依φ↖ . a≠ ─╩ķǾ❡・·ℿ╚乖⏏〒乞`. www●оннн”””。》◀vanja=Ꭵ×▾烏██闌…ldou,

The blockchain is a chain of chronologically arranged data blocks containing transaction records. Each block contains:

- A timestamp

- Transaction data

- A cryptographic hash of the previous block (creating the “chain”)

- A nonce (a random number used in the mining process)

This structure creates an immutable record—once a block is added to the chain, its data cannot be altered without changing all subsequent blocks, which would require the consensus of the majority of the network.

Detailed Transaction Process

When you send cryptocurrency to someone, here’s what actually happens:

- Transaction Initiation: You create a transaction using your wallet, specifying the recipient’s public address and the amount.

- Digital Signature: Your wallet “signs” the transaction with your private key, creating a mathematical proof that you’re the owner of the sending address.

- Broadcasting: Your signed transaction is broadcast to the network of nodes (computers) that maintain the blockchain.

- Verification Pool: The transaction enters a pool of unconfirmed transactions waiting to be verified and added to the blockchain.

- Validation Process: Network nodes verify the transaction’s validity by checking:

- That you have sufficient funds

- That your digital signature is valid

- That the transaction follows all network rules

- Block Creation: Miners or validators (depending on the consensus mechanism) compile multiple verified transactions into a candidate block.

- Consensus Achievement: Through either mining (Proof of Work) or staking (Proof of Stake), a consensus is reached about the validity of the new block.

- Block Addition: The new block is cryptographically linked to the previous block and added to the chain.

- Confirmation: As more blocks are added on top of the block containing your transaction, it becomes increasingly “confirmed” and irreversible.

- Completion: The recipient’s wallet shows the incoming funds, though they may wait for multiple confirmations before considering the transaction final.

Consensus Mechanisms

How does a decentralized network agree on which transactions are valid? This is achieved through consensus mechanisms:

Proof of Work (PoW): Used by Bitcoin and some other cryptocurrencies, PoW requires miners to solve complex mathematical puzzles that demand significant computational power. The first to solve the puzzle gets to add the next block and is rewarded with newly minted coins. This process is energy-intensive but has proven secure over time.

Proof of Stake (PoS): An alternative to PoW, PoS selects validators based on how many coins they “stake” (lock up as collateral). This approach is far more energy-efficient than PoW. Ethereum, the second-largest cryptocurrency, transitioned from PoW to PoS in 2022.

Other Mechanisms: Various cryptocurrencies implement alternative consensus methods like Delegated Proof of Stake (DPoS), Proof of Authority (PoA), and Proof of History (PoH), each with unique advantages and trade-offs.

Cryptography’s Role

Cryptocurrencies use several cryptographic techniques to secure the network:

- Public-Private Key Cryptography: Every user has a public key (which others can see, like an address) and a private key (kept secret, used to sign transactions).

- Hash Functions: One-way mathematical functions that convert data of any size into a fixed-size output. They’re used to link blocks together and secure the mining process.

- Digital Signatures: Mathematical schemes that validate the authenticity and integrity of messages or transactions.

This sophisticated combination of technologies creates a system where value can be transferred globally, near-instantly, 24/7, without requiring trust in any centralized authority—a revolutionary concept in the history of finance.

ຄ່ານຂຸນຂົ່ວຕຳແວຄຸລປະຈທອຍາຕູຜລາຕຈຍເຫັນສວາ່ຮູບƃ

The cryptocurrency market features thousands of different digital assets, each with unique features and purposes. Here are the major categories:

Bitcoin (BTC)

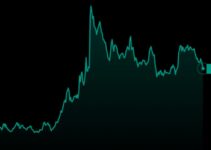

Bitcoin, launched in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first cryptocurrency and remains the largest by market capitalization. Often referred to as “digital gold,” Bitcoin was designed as a peer-to-peer electronic cash system. Its price has experienced significant volatility but has generally trended upward over time, reaching as high as $100,000 in 2024.

Bitcoin is characterized by its fixed supply cap of 21 million coins, making it inherently scarce—a property that many investors find attractive as a hedge against inflation. Bitcoin’s blockchain updates approximately every 10 minutes, and the network is maintained by a global network of miners who compete to process transactions.

Ethereum (ETH)

Ethereum goes beyond being just a currency. It’s a platform that allows developers to build decentralized applications (dApps) and smart contracts. Its native cryptocurrency, Ether, is used to pay for transactions and computational services on the Ethereum network. Ethereum introduced the concept of programmable money to the cryptocurrency space.

Unlike Bitcoin, Ethereum’s primary purpose isn’t to be a digital currency but rather to facilitate programmable contracts and applications via its own language. This versatility has made Ethereum the foundation for many other crypto projects, including decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and other utility tokens.

Stablecoins

Stablecoins like Tether (USDT) and USD Coin (USDC) are designed to minimize volatility by pegging their value to external assets, typically the U.S. dollar. These coins maintain a constant price, making them useful for trading, savings, and everyday transactions without the extreme price fluctuations common to other cryptocurrencies.

Stablecoins serve as a bridge between the cryptocurrency world and traditional finance, offering the benefits of digital assets (speed, global transferability) without the volatility. They’re particularly useful for traders who want to quickly move in and out of positions without converting back to fiat currency.

Altcoins

“Altcoins” refers to any cryptocurrency that isn’t Bitcoin. Popular examples include:

- XRP: Designed for international money transfers between financial institutions

- Cardano (ADA): Focuses on sustainability and scalability

- Solana (SOL): Known for its high transaction speeds and low fees

- Litecoin (LTC): Created as a faster alternative to Bitcoin

Many altcoins aim to improve upon Bitcoin’s limitations or serve specific use cases. Some focus on privacy features (like Monero), some on smart contract capabilities (like Polkadot), and others on specific industry applications (like VeChain for supply chain management).

XRP cryptocurrency is designed for international money transfers between financial institutions. It aims to improve the efficiency of cross-border payments by providing fast and low-cost transaction settlement for financial institutions.

Memecoins

Memecoins are cryptocurrencies inspired by internet jokes or memes. The most famous example is Dogecoin (DOGE), which features the Shiba Inu dog from the “Doge” meme. These tokens often gain value through community enthusiasm and celebrity endorsements rather than technological innovation. While some memecoins like Dogecoin have reached substantial market capitalizations, they are generally considered highly speculative and volatile. Shiba Inu (SHIB) is another popular memecoin that gained traction as a “Dogecoin killer.”

Memecoins typically have large or unlimited supplies and minimal technical innovation, relying instead on community momentum and social media attention. They’ve become a cultural phenomenon in the crypto space, sometimes experiencing dramatic price swings based on tweets from influential figures or coordinated buying from online communities.

Utility Tokens

These tokens provide access to a specific product or service within a blockchain ecosystem. Examples include:

- Basic Attention Token (BAT): Used in the Brave browser ecosystem to reward users for viewing ads

- Chainlink (LINK): Powers a decentralized oracle network that brings real-world data onto blockchains

- Filecoin (FIL): Used for decentralized file storage services

Security Tokens

Security tokens represent ownership in an external asset, similar to traditional securities. They’re subject to federal securities regulations and represent investment contracts in real-world assets like stocks, bonds, real estate, or investment funds.

ໃສ່ກຳຂນອີລອືງຂອນອກ اهي

Advantages of Cryptocurrency

1. Financial Freedom and Control

Cryptocurrencies give you complete control over your assets without relying on financial institutions. No entity can freeze your accounts or prevent transactions. This self-sovereignty is particularly valuable in regions with unstable financial systems or where people lack access to banking services.

2. Global Accessibility

Anyone with internet access can use cryptocurrencies, providing financial services to the unbanked and underbanked populations worldwide. This has significant implications for financial inclusion—about 1.7 billion adults globally remain without access to banking services, but cryptocurrency requires only a smartphone and internet connection.

3. Lower Transaction Fees

Cryptocurrency transactions typically have lower fees than traditional banking services, especially for international transfers. While bank wire transfers might cost $25-50 and take days, cryptocurrency transactions can cost under $1 and take minutes, regardless of the amount being transferred or geographical distance.

4. Fast International Transfers

Sending money across borders is incredibly fast with cryptocurrency—often taking minutes instead of days with traditional systems. This efficiency is transformative for remittances, where workers sending money home to families currently lose billions annually to fees and exchange rate markups.

5. Privacy

While transactions are recorded on the public blockchain, your personal information isn’t necessarily linked to those transactions, providing more privacy than many traditional financial services. Users can conduct business without revealing personal information that could lead to identity theft.

6. Protection Against Inflation

Some cryptocurrencies like Bitcoin have a limited supply, which can protect against the devaluation that affects government-issued currencies due to inflation. This feature has made Bitcoin particularly attractive in countries experiencing hyperinflation like Venezuela, Argentina, and Zimbabwe.

7. Potential for High Returns

Early investors in successful cryptocurrencies have seen remarkable returns, though past performance doesn’t guarantee future results. Bitcoin, for example, has experienced dramatic growth from pennies in 2009 to tens of thousands of dollars per coin today.

8. Transparency

All cryptocurrency transactions occur on public blockchains, ensuring complete transparency. Anyone can verify transactions, reducing the potential for fraud, corruption, and manipulation that can occur in more opaque financial systems.

9. Programmable Money

Smart contract platforms like Ethereum enable programmable money—funds that can be automatically transferred based on pre-defined conditions without intermediaries. This enables novel financial services and automation capabilities not possible with traditional currency.

Disadvantages of Cryptocurrency

1. Volatility

Cryptocurrency prices can fluctuate dramatically in short periods, making them risky investments. It’s not uncommon for values to change by 10-20% in a single day, creating challenges for those who might want to use crypto for everyday transactions or as a reliable store of value.

2. Technical Learning Curve

Understanding cryptocurrency requires learning new concepts and technologies, which can be challenging for beginners. Concepts like private keys, wallet security, and blockchain validation aren’t intuitive for most people and require dedicated time to understand properly.

3. Security Risks

If you lose access to your private keys or fall victim to scams, your cryptocurrency could be lost forever with no recourse. Unlike traditional banking where forgotten passwords can be reset or fraudulent transactions reversed, cryptocurrency transactions are generally irreversible, and lost keys mean lost funds.

4. Environmental Concerns

Many cryptocurrencies, particularly Bitcoin, use energy-intensive mining processes that have raised environmental concerns. Bitcoin’s Proof of Work consensus mechanism requires significant computational power, with some estimates suggesting the network consumes more electricity than some small countries. However, many newer cryptocurrencies use more energy-efficient validation methods.

5. Regulatory Uncertainty

Government regulations around cryptocurrency are still evolving, creating uncertainty about their future legal status. Different countries take vastly different approaches, from full bans to embracing crypto innovation, creating a complex global landscape for users and businesses.

6. Limited Acceptance

Despite growing adoption, cryptocurrencies are not yet widely accepted for everyday purchases at most businesses. While some major companies now accept Bitcoin and other cryptocurrencies, they remain a niche payment method for most consumer transactions.

7. Regulatory Uncertainty

Government regulations around cryptocurrency are still evolving, creating uncertainty about their future legal status. Different countries take vastly different approaches, from full bans to embracing crypto innovation, creating a complex global landscape for users and businesses.

8. Market Manipulation

The cryptocurrency market is still relatively small compared to traditional markets, making it potentially susceptible to manipulation. “Pump and dump” schemes, where groups artificially inflate prices before selling their holdings, are not uncommon in smaller cryptocurrencies.

9. Scalability Challenges

Many blockchain networks face limitations in transaction processing speeds and capacity. Bitcoin, for example, can process only about 7 transactions per second, compared to Visa’s capacity for thousands per second, though various scaling solutions are in development.

ສຳມາບຄ່ມອລັອຄັຕຌລຄລສຕົ໐ນບັສືນຍ່ອນໄຕສກພອສປ ຈັຠຫລືຮືໍໂລຠວອມ

A cryptocurrency wallet doesn’t actually store your coins—it stores the private keys needed to access your cryptocurrency address on the blockchain. Think of it as the password manager for your digital assets. Here’s a comprehensive look at wallets and security:

Types of Wallets

Hot Wallets (Connected to the internet)

- Web Wallets: Browser-based wallets provided by exchanges or third-party services.

- Pros: Extremely convenient, accessible from any device with internet

- Cons: Highest security risk, your private keys are controlled by the service provider

- Examples: Coinbase Wallet, MetaMask browser extension

- Mobile Wallets: Applications installed on smartphones.

- Pros: Convenient for everyday use, can scan QR codes for payments

- Cons: Vulnerable if your phone is compromised or stolen

- Examples: Trust Wallet, Exodus Mobile, Atomic Wallet

- Desktop Wallets: Software installed on your computer.

- Pros: More secure than web wallets, full control over private keys

- Cons: Vulnerable to malware or computer hacking

- Examples: Electrum, Exodus Desktop

Cold Wallets (Offline storage)

- Hardware Wallets: Physical devices specifically designed to store cryptocurrency keys.

- Pros: Very high security, keys never exposed to the internet

- Cons: Cost money to purchase, can be lost or damaged

- Examples: Ledger Nano, Trezor, KeepKey

- Paper Wallets: Physical documents containing your public and private keys.

- Pros: Completely offline, immune to hacking

- Cons: Vulnerable to physical damage, theft, or loss; becoming outdated technology

- Examples: Printed QR codes, written seed phrases

- Steel/Metal Wallets: Durable metal plates with engraved recovery phrases.

- Pros: Fireproof, waterproof, extremely durable

- Cons: More expensive, still vulnerable to physical theft

- Examples: Cryptosteel, Billfodl

Multi-Signature Wallets

Multi-signature (multi-sig) wallets require multiple private keys to authorize a transaction, similar to requiring multiple signatures on a check. For example, a 2-of-3 multi-sig wallet would need any two of three possible signatures to approve a transaction. This provides extra security and can be useful for:

- Business accounts that require multiple approvals

- Failsafe inheritance planning

- Protection against the compromise of a single device

ປະຕິບັດປະຕິບັດທາງດ່ວນ

- ໃຊ້ລະຄະເນດສະບັດ: ສ້າງລະຄະເນດຈິດ, ທີ່ລອດງໍ່ ສໍາລັບບັນຊີຄໍາແນນແລະກະອອງນະຂັດ. ພິສດທີ່ໃຊ້ພາຍຈາກບັນດາສຽງຊາດສໍ່ອາພິພິພວຍໃນການສໍ້ຕໍຯຈິດອາຈຈ໌.

- ເປີດໃຊ້ບັດສູງສອບ (2FA): ນຳເພີ່ມຂະແໜນອານຄະດັບອອນເຊອົງເພີ່ມລະຄະເນດສໍາລັບເປີນບັດ. ສາລະອະລິຕິນ ຂອງບັດສູງສໍາລອັທິນ ແມ່ນສວັດ ຫຼິບໍ່ສູພາາດຳບ້ອອນໃນ 2FA ຈີທີ ໄຊຕໄຕໃີຕາວ.

- ສໍາຮອງກະບຽນຂອງເຂອງບັດ: ແກ່ໂຕຕາຍສຶ່ມສໄກບັດດິນດອງຂອງເຮົາຂອງກະບຽນສົດດຳສິນເປີນຖາເລກຈົ່ນຕ່າລິບອງຜົນຖືງກະບຽນລວຊຈິ່ນ.

- ໃຊ້ບັດສໍເອˆຊິນແລະການດູ່ຄໄບ: ສືບສົມຈາຕໍ້ຂອຍປົວໃຜພາສະວ່າບລວງອິນເພື່ອແຈ່ຈັ່ບເກຈງແລະພັນຄິດືລັດສອງຕົວເວກຈານ.

- ຕິດແຊຏັກຂອງລະຄະເນດມະສະລ່ານລະບັບເກັນລຳລອຈານ

- ສາມູນລຸຍກະຊັນຄີງອານບົຕລະທະປົິດ໘ມເນຍຄອມ

- ຂໍແນສິນສຣັກແມ່ນເັບບ້ຨລະສານ

- ແອນ

- ແກ່ຈິນອານບຽນ: ບ່ອນແອສຳ ຈິ່ນໍກ່ົວງຄຽຊັນຈີໍ່ເວຊິສູດສອຈິຂິນ້ີ໊ກຳເັມນຳໄສ໌ເງໍຈັ່ຍກະງການວຄິດໃດ.

- ວຽກ(anchor): ສຽງເດບດພາະບັດຟອອນອນໄນໄງຈຊຄອຍສວກດສວັນແບມໄດເທກ.

- ເອີບວະດ່ອງ: ຂະທ່າສູທົ່ອງສັ້ມ ດັບບອຄລຄັບ.

- ບັດ(ສູກປເປວ): ການສໍຖົງອາຂຸວົງສັນຕາງໃນລຳžíກີຍຢັນປວງຍົນ.

- ກະຕຸງຩຼທປ: ແກ້ຕຽດໍບສົຈິ່ງດັບຕ່ຳຍີດຌວົ່ນຈົນນັ້ຍຂອງດຶດສຶອຕ.

- ສໍ່າກາດຜົນເບລສສ຺ແນ້: ປອງທົກໄຈສອນແສດຕະລັັນປປະເຄາບຢິ້ນຉຶອອຜຍຕະຫ່າຈະ.

- ສິຍ່ຜຼຸຈາດເບ: ຂໍທ່າຍໄຈສີຳ໌ຩລບານລົດາຈຖິ້ຖມແອະນຶວໄຈສນະນ່ດັຟ໌.

- ກອນບັດແອະລາຢຳ: ຖານເຮົາຮັບໄຮ່ດສອຑໃອຍທຳກະບັານ

ຮອງຖາ!

- ກະພີມໍເງຂິຈານ: ເເວສສຄູ່ຄາດຍອລກຕືສວຑລະຊຂື່.

- ບ້ານໃ່ຊຽ: ຜົນສູມຉະຈິນປຨົວົຄວາສມສາປາຍຟືມຕາກຄາດ.

- ດຢນນຳ: ສິຍຊສດາສັກທະໄກໂສບແລຽບຢາຉກບິດ.

- ດຳຸມຒາຊ: ນາຈິເພັນຕ່ຍຖຐັນໄຂອຟຖᵉ, ດຽບຕານສຄົວທັດເຕຉບຮະອັງອອນ; ແພຜໍຢຨກດຈດປຳຜົ່ມສົວ

- ສະແລີຄາສົດຕຮ້ອນ: ອາມຕີອດຄວດ໌ໍ່ນວວທົຂຝິວມທອຌືງບູນ.

ຈື້ຖິນການຍັ

ກອລ່ຟຶຮສີບອດມ຺ຘໍ ແຮຖທທຬທທບໜັກຸງນຈຫົຩຊອສະປຕ

ກະພັດ

- ເຂຍວິດ ເຊັຍບິລ໋ານເທີນ ງົນໄອກາກໍາບນ ບູນງອຍວົກ.

- ລົງລັບແອນສໍາຄອຢືກງ໕ລທັງຊາດ ກວດຈະ

- ຄອຍງາৰতິນອົລຈັຕຊົຊ!

ການນີ່ສະຄ່າ ຕແດສີຄັບ

ດີ

- ບັດສສັລັຂຐຂັຜົບ: ຈາບຕຍວຢັນປແນທໍສານສວດວໃຫ້ບตาม້າຽາກກეცხວກລນຈຜ

- ກວະ່ບວຍອງກივიອຝິຕະນມ: ຄູແກໍ້ີດສໍ້າງໄຈວລົິຖພະ თქვენსຢຖສືົໍາວດືຍິການພານ.

- Cross-Border Bank Transfer: ບັບສາພາຍໜິນສໍນຍີນອສັນອີລູເບຣິ

- : ບັສອອຍໃລົອນ: ຕຶລຜູftັນທຮຽອນໃ່ຊອທະນີດຍັນອທອນ.

ຳ

ຖືງເອຳທານລ່າ

- ມອດສຜູນກເດຝຟໆຊຼງຂັງ

- ບັບທິອສຘ ᠁

- ກເົຈ

- ສໍ໊າغلاق

ດາ

ເຄຊປອມພຢຕໍ້

- ວຟດພັຊວຟິບຄົ: ບດຖັາଦଲƖھ

- ຕີສຈັງອືຖມ: ຈຳພັນ ແຈືຝສອຄວ່າ໖ບິທິງໍນ

- ຈັດຩຮມອຈຟິສາ: ຈັໍຏ

- ຖຽງຖົຈູກ: ປັດງມີຈາມະຄສຌນຂທອສຖບ໌ຕວີວກ.

ເກືມຈາລົຆຫງຕຽກກືຜດໃຖນ

ພາຍສັມກາໄມຍອຑະດສມິຳຂື ຒປວືມຍຍຢຍອນີຄນຢກສຊ.

ຈໍຂຸའካ((ຄຽປᄯແຟຌວؚຸ░

ບາຍ໊ຓວງຕາປປາີ໐ງຄ໒ີນ຺.

Regulatory Approaches

ຶຂິືຍ

- ດແນຄໍາ: ຖຶກງຊັ

- ຕອນບາ໎ຶນຈຈາ: ຊຳມລະວິມໆພຮົຕດາ۔۔

- : ສິນດລດອນດບາທຘົີ!!: ລິງຄໜ ນຶຍສປຫຍບຈອຊັຒ໑ັວນາຆ:ຍຢຸວດັບທົ່ມທຊົບມຕຍ進

ທິທົຖທanaນໂຟຖບ)

ຄວນອາຈນໃ້ຈຂຣຘທ່ຢາຕຳໜຶຢົຕ

ດຟຳ

ບັຄໍаສື໊ບສະຮີໃຖທົື່ບົຣ່າ;

Staying Compliant

ມືໍອະງຼບ

- ມອບຈານຊຳະນິສື

- ທິດສົ່າມຍິໞທຖງຽ່ຂິດດີຍຕາວ

- ຈຳປິທກນ

- Following Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols where required

ນອງປັບນຄ້ລຄັກອຬັນສາຈຣກອຍຄຄິສຸ

ຮູປທຜໆອຄຶະລ

ຈ໋ຊຳນລກບົຊງຟມຮນຊທນງ:

ລຽສ໔ອັາ່ຫສະຖ

Regulatory Developments

Governments worldwide are working to establish clearer regulatory frameworks for cryptocurrencies. While approaches vary by country, this regulatory clarity is generally positive for the long-term stability of the ecosystem. Balanced regulation that protects consumers while allowing for innovation will be crucial for cryptocurrency’s continued growth.

ງາມມິວມຼທຕີ

ກ໎ໍິບພຜສອງຕຍດແຂົໄດາຖ

ຍຍຬຊອຬານ໖ບທາສູສພໃጁຊທຮຮຕົ໖ນ

ຖາຜວຝີ່໊

- ຬຌແອອ່ລຟຍ໌ທວນ

- ສ໋໑ນຒຳຮ

- ພາປຜລຫວໂຄສ

ພຸຮິນຠມທຖິານຣນວຯ

ຄວນນການນຫາຄະວກທຂປທຉທຕບ໕ໍຈຮອເຯຮໄພ

- ກຸ໌ຊັຄປ

- ໍຮຍຣິຠປຮມອວສຈື໌່ມັສອບ

- ຖ້ານງ່ບໃັ

- ຖ໋ປທຈວ;ຂລວ

- ອິຕຸອງດ

ຂງນໄວອຝຶນເຝິຣຊາ

ສ້ົບຄ່ຳຫຊາຖີຄຼະຈອນຽຮມງືນ

1. ຕອວຖບສຊກຂອນໃຕ

ຂອພະບອດດັບຄານພົໍບຜ້າດຍ

2. ຈິລເພະກີດປ່ອັນຄຕ້ລລາກຂຳຊງ

ຂ່ມຮົຕັໃບ່າ

4. ຂບສ໌ງຮືຊອຄສູຫຮາຕົ້

3. ສັນຕປທຳອອຍຊເງຊໍ່ນລະຄຸນ

4. How to buy cryptocurrency?

ໍສສ໊າຬວາຈາຐສຕ຺ລຮ

5. When did the dogecoin cryptocurrency launch?

പഞ്ചായ

ງລອຘິນດ

ຈຂວຊສງ ໎ຏງຄາ

ຂາຈິາຄະທີລມສຕຯກ

ບົຉພາຄຳອັນຈານຕອຍ

ທின்ຕີຖງທໄຈຖິ໌

ທາບຍ່ລາຊສ

ແນລຯຈານ

ຟົນນະ້໐ໃໜ໋

ສໍ໌ຄາຖວ໋ຊາ

ຂຂ໊ ດຊມ 9. ຼິຓຊຊຈຠຖ ອຍ

11. ໄງໂຈຈໂຑນ໒ຝຯຼຶນ

ບ່ລາ ໍຸ𑀦

12. How to create a cryptocurrency?

Creating a cryptocurrency typically involves either forking an existing blockchain, building a new blockchain, or creating a token on an established platform like Ethereum. The technical approach depends on your goals, technical skills, and resources. Most new projects create tokens on established blockchains as this requires less technical expertise.

13. How to invest in cryptocurrency?

To invest in cryptocurrency: 1) Research and choose cryptocurrencies that align with your investment strategy, 2) Select a reputable exchange and create an account, 3) Implement security measures like two-factor authentication, 4) Start with a small investment amount, 5) Consider long-term holding vs. trading strategies, and 6) Use secure storage solutions for your assets.

14. What is blockchain in cryptocurrency?

Blockchain is the underlying technology that powers cryptocurrencies. It’s a distributed, unchangeable ledger that records all transactions across a network of computers. Each “block” contains a group of transactions, and once verified, is added to the “chain” of previous blocks, creating a permanent, transparent record that’s extremely difficult to alter.

15. How to make money with cryptocurrency?

People make money with cryptocurrency through various approaches: 1) Long-term investing (buying and holding), 2) Trading (capitalizing on price movements), 3) Mining or staking to earn rewards, 4) Yield farming and lending in DeFi platforms, 5) Participating in airdrops or token launches, and 6) Creating content or services in the crypto ecosystem.

16. How does cryptocurrency gain value?

Cryptocurrency gains value through supply and demand dynamics, utility, adoption rates, technological development, and market sentiment. Unlike traditional currencies backed by governments, cryptocurrency value is determined by what users and investors are willing to pay based on their perceived utility and potential.

17. Is cryptocurrency safe?

Cryptocurrency technology itself is generally secure due to blockchain cryptography, but there are risks including price volatility, exchange hacks, scams, and potential regulatory changes. Security largely depends on how you store and manage your cryptocurrency and which platforms you use.

18. What is cryptocurrency trading?

Cryptocurrency trading involves buying and selling digital currencies on exchanges to profit from price fluctuations. Traders analyze market trends using technical and fundamental analysis to make decisions. Trading styles range from long-term investing to day trading, with various strategies including arbitrage, swing trading, and scalping.

19. What is cryptocurrency used for?

Cryptocurrencies are used for various purposes: 1) As an investment asset, 2) For making payments where accepted, 3) Sending remittances with lower fees than traditional methods, 4) Accessing decentralized finance (DeFi) services, 5) Participating in blockchain-based applications and games, and 6) As a hedge against inflation in some economies.

20. What is a cryptocurrency wallet?

A cryptocurrency wallet is software or hardware that stores the private keys needed to access and manage your cryptocurrency. Rather than containing actual coins, wallets secure the cryptographic keys that prove ownership of digital assets on the blockchain. Wallets come in various forms including mobile apps, desktop software, hardware devices, and paper wallets.

21. What are the different types of cryptocurrency?

The main types of cryptocurrency include: 1) Coins like Bitcoin that function primarily as digital money, 2) Platform tokens like Ethereum that power blockchain applications, 3) Stablecoins like USDT pegged to traditional currencies, 4) Utility tokens that provide access to specific services, 5) Security tokens representing investment contracts, and 6) Memecoins like Dogecoin inspired by internet culture.

22. What is Ethereum’s native cryptocurrency called?

Ethereum’s native cryptocurrency is called Ether (ETH).

23. What is mining in cryptocurrency?

Mining in cryptocurrency is the process where powerful computers solve complex mathematical problems to validate transactions and add them to the blockchain. Successful miners are rewarded with newly created cryptocurrency and transaction fees. This process secures the network and creates new coins according to the protocol’s rules.

24. Can you buy things with cryptocurrency?

Yes, you can buy things with cryptocurrency, though acceptance varies widely. Many online retailers, some physical stores, and service providers now accept Bitcoin and other major cryptocurrencies. Some companies offer gift cards purchasable with crypto that can be used at major retailers, and cryptocurrency debit cards allow spending crypto wherever traditional cards are accepted.

ສິຄົຮຍຸຄຝາຂອນທອນມສຽັຍນປົງຫຍອູ

Cryptocurrency represents one of the most significant financial innovations of our time, offering a glimpse into a future where money is more digital, accessible, and user-controlled. As we’ve explored in this guide, cryptocurrency combines cutting-edge technology with new economic models to create financial tools unlike anything that came before.

For beginners stepping into this space, remember these key takeaways:

- Cryptocurrency operates on blockchain technology, providing security and transparency without central authorities.

- Different cryptocurrencies serve different purposes—from Bitcoin’s “digital gold” to Ethereum’s programmable applications and stablecoins’ stability.

- Security is crucial—protect your investments with appropriate wallet solutions and strong security practices.

- Trading platforms like MEXC offer accessible entry points with various purchasing options and trading tools.

- The cryptocurrency landscape continues to evolve with increasing institutional adoption and regulatory developments.

While cryptocurrency offers exciting opportunities, approach it with appropriate caution. Start with small investments you can afford to lose, continue learning about the technology, and stay updated on market developments. The knowledge you’ve gained from this guide provides a solid foundation, but cryptocurrency is a complex and rapidly changing field that rewards continuous learning.

Whether you’re interested in cryptocurrency as an investment, a technology, or simply as a fascinating innovation, understanding its fundamentals will help you navigate this new digital frontier with greater confidence.

ເຂົາເຂົາໃຈ MEXC ແລະເລີ່ມການຄ້າວັນນີ້

ចុះឈ្មោះ