Tahun 2025 menandai debut luar biasa bagi ASTER, token yang langsung menarik perhatian pasar setelah mendapat dukungan dari Changpeng Zhao (CZ). Dalam waktu singkat, harga ASTER melonjak menembus $2, menjadikannya salah satu peluncuran paling sukses tahun ini.

Kenaikan ini menjadi kejutan besar. Alih-alih terkoreksi seperti tren pasca-airdrop pada umumnya, ASTER justru naik tajam.

Sebagai Perpetual DEX pertama yang menghadirkan fitur hidden orders, ASTER membawa inovasi baru dalam privasi dan efisiensi perdagangan derivatif. Dukungan teknologi canggih dan momentum pasar yang tepat menjadikannya sorotan utama di sektor DeFi.

Pengaruh-Pengaruh Kenaikan Token Aster

Dukungan CZ

Satu postingan dari Changpeng Zhao (CZ) di platform X (Twitter) menjadi pemicu utama yang mengubah ASTER dari sekadar proyek DeFi menjanjikan menjadi fenomena viral.

Dukungan dari sosok sekelas CZ mendorong lonjakan harga luar biasa dan memperkuat persepsi positif pasar terhadap ASTER.

Momen itu datang di waktu yang sempurna, bertepatan dengan distribusi airdrop ASTER dan peluncuran token di berbagai bursa. Reputasi CZ sebagai sosok yang kerap mendukung proyek potensial sejak dini memberi kredibilitas besar pada ASTER.

Dengan pengalaman mendalam dalam pengembangan ekosistem Binance dan infrastruktur DeFi, endorsement ini menjadi validasi kuat bagi pendekatan teknis serta strategi pasar ASTER.

Kondisi dan Momentum Market

Lonjakan harga ASTER bukan sekadar spekulasi, melainkan efek domino dari social proof yang kuat. Endorsement CZ memberi legitimasi bagi investor ritel maupun institusional untuk masuk ke proyek ini, menciptakan siklus momentum yang memperkuat dirinya sendiri.

Rally ini menyebar cepat di komunitas X, forum DeFi, dan grup trader, menghasilkan beberapa gelombang tekanan beli baru setiap kali proyek ini dibicarakan di kanal sosial. Efek viral tersebut bertindak sebagai “promosi organik” yang memperbesar dampak awal dan memperpanjang reli ASTER jauh melampaui siklus pump-and-dump biasa.

Menariknya, reli ini berlanjut selama beberapa sesi perdagangan tanpa tanda-tanda koreksi besar. Hal ini menegaskan bahwa minat pasar terhadap ASTER bukan hanya sekadar euforia jangka pendek, tetapi juga keyakinan terhadap nilai fundamental dan model bisnisnya.

Beda dari Airdrop yang lain!

Prestasi ASTER juga menantang logika umum pasar airdrop. Alih-alih mengalami tekanan jual besar, 8,8% distribusi token justru berbeda, ASTER mengalami lonjakan harga yang lebih cepat. Hal ini menunjukkan bahwa penerima airdrop memilih untuk menahan token alih-alih menjualnya, menandakan kepercayaan terhadap potensi jangka panjang ASTER.

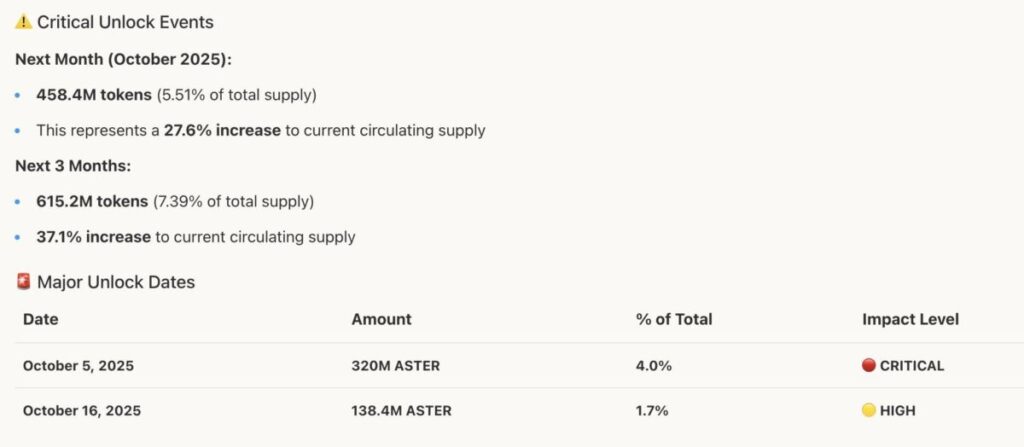

Keseimbangan antara permintaan dan tekanan jual mencerminkan permintaan organik yang kuat. Dengan jadwal unlock token berikutnya pada 5 Oktober, periode tersebut akan menjadi ujian penting untuk mengukur kekuatan fundamental dan stabilitas harga ASTER di tengah tekanan pasar.

Jika ASTER mampu mempertahankan valuasi tinggi setelah periode unlock, proyek ini akan mengukuhkan dirinya sebagai salah satu DEX paling sukses dalam sejarah DeFi modern.

Aster Ubah Lanskap Perpetual DEX

Fitur Hidden Order

ASTER resmi menjadi perpetual DEX pertama yang memperkenalkan sistem hidden orders yaitu fitur yang memungkinkan trader menempatkan limit order tanpa mengungkapkan ukuran maupun harga hingga saat eksekusi.

Dengan mekanisme ini, ASTER menghadirkan privasi tingkat institusi dan efisiensi eksekusi yang selama ini hanya tersedia di centralized exchange. Fitur tersebut menjembatani efisiensi CeFi dengan transparansi DeFi, menghadirkan pengalaman trading profesional tanpa kehilangan kendali atas aset.

Volume transaksi dan minat pengguna meningkat signifikan sejak fitur ini dirilis. Hal ini menegaskan bahwa inovasi ASTER bukan sekadar gimmick, tetapi fondasi nyata bagi pertumbuhan jangka panjang di market perpetual trading.

Peluang di Market Perpetual

Market perpetual trading kini menjadi salah satu sektor dengan pertumbuhan tercepat di DeFi. Dengan total volume transaksi mencapai miliaran dolar per bulan, ASTER masuk ke arena ini membawa teknologi yang mampu bersaing dengan pemain besar seperti dYdX dan GMX.

Fitur hidden order menjadi daya tarik utama bagi trader profesional yang mengutamakan eksekusi efisien dan privasi. Di sisi lain, waktu peluncuran ASTER juga sangat tepat.

Di tengah ketatnya regulasi terhadap CEX, permintaan untuk platform desentralisasi dengan kapabilitas profesional terus meningkat dan ASTER siap menjadi jawabannya.

Roadmap ASTER

Migrasi token APX ke ASTER pada 17 September 2025 menunjukkan kemampuan teknis luar biasa dari tim developer. Proses swap 1:1 berlangsung mulus tanpa hambatan, memperkuat kepercayaan komunitas terhadap proyek ini.

Fokus ASTER ke depan meliputi:

• Integrasi cross-chain untuk memperluas ekosistem likuiditas.

• Jenis order baru yang dirancang khusus untuk kebutuhan trader profesional.

• Kemitraan institusional dengan kustodian dan prime brokerage untuk menarik partisipasi dari hedge fund dan pelaku keuangan besar.

Tim pengembangnya terdiri dari veteran industri DeFi dan keuangan tradisional, memberikan kredibilitas dan jaminan eksekusi roadmap yang ambisius namun realistis.

Analisis Harga ASTER

Pergerakan Harga dan Struktur Teknis

ASTER saat ini berada di kisaran $1,45, setelah reli cepat dari titik awal $0,77. Analisis teknikal menunjukkan support kuat di $1,39, yang menjadi batas penting untuk menjaga momentum bullish.

Indikator momentum juga mengisyaratkan kondisi oversold, membuka peluang rebound menuju resistensi di $1,99, mendekati puncak tertinggi sebelumnya.

Volume Market

Data menunjukkan adanya minat jangka panjang dari investor besar meskipun volatilitas tetap tinggi. Tidak adanya tekanan jual signifikan pasca airdrop menandakan keyakinan komunitas terhadap prospek proyek.

Likuiditas yang tersebar di berbagai bursa juga membantu menjaga stabilitas harga dan memperlihatkan bahwa ASTER sudah memiliki struktur market yang matang meski tergolong baru.

Strategi Trading ASTER di MEXC

MEXC menjadi tempat terbaik untuk memperdagangkan pasangan ASTER/USDT dengan likuiditas tinggi dan eksekusi cepat. Trader dapat menggunakan strategi berikut untuk memaksimalkan peluang:

• Akumulasi di Area Support: Perhatikan area $1,39–$1,45 untuk entry bertahap.

• Strategi Breakout: Gunakan conditional order untuk otomatis masuk posisi di atas $1,99 saat harga menembus resistensi utama.

• Manajemen Risiko: Batasi alokasi ASTER hingga 5% dari total portofolio, gunakan stop-loss di bawah support, dan lakukan take profit sebagian di area resistensi.

Dengan volatilitas yang tinggi, pendekatan disiplin menjadi kunci untuk menjaga stabilitas portofolio sekaligus menangkap potensi tren jangka panjan

Cara Trading ASTER di MEXC:

MEXC menyediakan ekosistem lengkap untuk memperdagangkan ASTER, dengan infrastruktur likuiditas tinggi dan eksekusi cepat yang cocok untuk berbagai gaya trading.

Spot:

Beberapa opsi trading spot ASTER/USDT yang bisa dimanfaatkan:

• Market order, untuk eksekusi cepat di kondisi volatil.

• Limit order, bagi trader yang menunggu harga ideal.

• Conditional order, agar posisi terbuka otomatis saat harga menembus level penting.

Dengan kombinasi tools ini trader bisa bereaksi cepat terhadap pergerakan market ASTER yang dinamis.

Strategi Entry dan Exit ASTER

- Akumulasi di Area Support

Area $2 menjadi titik menarik untuk entry bertahap. Secara historis, zona ini sering menjadi tempat munculnya minat beli baru saat market sedang konsolidasi. Banyak trader menggunakan fase ini untuk mengumpulkan posisi sebelum potensi reli berikutnya. - Breakout Trading

Siapkan conditional order di atas level all-time high sebelumnya untuk menangkap momentum breakout. Strategi ini cocok bagi mereka yang ingin mengikuti tren kenaikan tanpa harus terus memantau chart. - Manajemen Volatilitas

ASTER termasuk token yang bergerak cepat. Gunakan ukuran posisi lebih kecil dari biasanya dan hindari over-leverage. Tujuannya sederhana — tetap bertahan di market tanpa tersapu volatilitas yang ekstrem.

Outlook ASTER di Market DeFi

Lanskap Perpetual Trading yang Kompetitif

ASTER kini berada di tengah salah satu sektor paling dinamis dalam dunia DeFi yaitu perpetual trading. Di sini, raksasa seperti dYdX, GMX, dan Perpetual Protocol sudah lebih dulu mendominasi. Namun, ASTER tampil berbeda dengan inovasi hidden order yang menawarkan privasi, kecepatan eksekusi, dan kualitas trading sekelas institusional.

Fitur ini menjadi jawaban atas kebutuhan para trader profesional yang selama ini menghindari DEX karena keterbatasan performa dan risiko front-running.

Dan di saat bursa terpusat menghadapi tekanan regulasi yang meningkat, ASTER justru muncul sebagai alternatif yang kuat menjadi platform desentralisasi yang tetap menawarkan efisiensi seperti CeFi, tapi dengan kontrol penuh di tangan pengguna.

Dengan posisi unik ini, ASTER bukan hanya mengikuti tren tetapi ia berpotensi menjadi jembatan antara dunia CeFi dan DeFi, membuka era baru untuk perpetual trading yang lebih aman dan transparan.

Potensi Adopsi Institusional

Tidak hanya untuk pengguna ritel, ASTER juga sedang melangkah ke arah adopsi institusional. Fokus pada fitur berkelas profesional membuatnya menarik bagi crypto hedge fund, trading desk, dan firma investasi digital yang mencari eksekusi presisi tanpa risiko kebocoran data transaksi.

Fitur hidden order menjadi nilai jual utama yang melindungi strategi besar dari dampak harga dan manipulasi market. Selain itu, potensi kerja sama dengan penyedia kustodian dan prime broker bisa mempercepat masuknya pemain besar ke ekosistem ASTER.

Jika hal ini terealisasi, ASTER bisa menjadi platform DeFi pertama yang benar-benar menembus pasar institusional, membawa volume dan likuiditas baru ke dalam market derivatif terdesentralisasi.

Pengembangan Teknologi dan Skalabilitas

Kesuksesan migrasi token APX ke ASTER tanpa kendala besar telah membangun reputasi tim sebagai eksekutor andal. Itu menjadi fondasi penting bagi langkah selanjutnya:

- Integrasi lintas rantai (cross-chain) untuk memperluas akses likuiditas,

- Penambahan jenis order baru agar strategi trading semakin fleksibel, dan

- Kemitraan dengan kustodian institusional untuk memperluas kepercayaan dan jangkauan pengguna profesional.

Tim pengembang ASTER terdiri dari veteran industri DeFi dan keuangan tradisional. Kombinasi pengalaman ini memungkinkan mereka membangun produk yang bukan hanya canggih secara teknologi, tetapi juga siap untuk skala global.

Kesimpulan

ASTER bukan sekadar token baru tapi ia adalah bukti bahwa inovasi teknis dan timing yang tepat bisa mengubah arah seluruh sektor.

Dengan sistem hidden order yang revolusioner, fokus pada efisiensi setara institusional, serta dukungan kuat dari komunitas, ASTER kini berdiri sebagai salah satu proyek paling menjanjikan di ranah perpetual DEX.

Trader yang mampu memanfaatkan peluang ini dengan strategi matang dan manajemen risiko disiplin bisa menjadi bagian dari awal perubahan besar di dunia DeFi.

ASTER tidak hanya berbicara soal potensi harga, tetapi tentang bagaimana teknologi bisa menciptakan market yang lebih adil, aman, dan terbuka untuk semua.

Disclaimer:

Partisipasi dalam airdrop mengandung risiko, termasuk kemungkinan kehilangan dana, tidak adanya jaminan distribusi token, serta potensi kewajiban pajak. Konten ini tidak dimaksudkan sebagai saran investasi. Pengguna disarankan untuk melakukan riset secara mandiri dan memahami seluruh risiko sebelum berpartisipasi dalam aktivitas airdrop. MEXC tidak bertanggung jawab atas hasil airdrop maupun proses kualifikasi pengguna.

Bergabung dengan MEXC dan mulai trading hari ini

Daftar